Thank you to Sid Gandhi and Calum Moore for valuable feedback and review.

The views expressed in this post are solely my own, and do not necessarily reflect those of the reviewers.

Digital Cash

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Nearly 17 years after the Bitcoin Whitepaper, the world still doesn’t have digital cash with the properties of physical cash.

For many years, the primary blocker was the asset. Most people want to buy their coffee with USD, not BTC. Stablecoins fix this.

Today, the payment rails are the primary blocker. Most digital protocols don’t preserve the key properties of physical cash. In particular, physical cash is fully private. I can just hand you a dollar. We would never announce it to the entire world, but that’s exactly how crypto works today. Even intermediated payments (e.g., credit cards) only require disclosure to select trusted entities.

It would be dystopian if crypto’s transparent infrastructure was adopted at scale, but it’s even more likely that this transparency would simply prevent most adoption. People won’t move onchain just to get far worse guarantees than they already have offchain:

- Normal users won’t adopt a system where their full financial profile could be trivially identified and doxxed for everyone to see. In an industry increasingly plagued by wrench attacks and data leaks uprooting people’s lives, users are likely to want more privacy, not less.

- Institutions are explicitly unable to make all of their operations transparent. A TradFi survey conducted earlier this year showed lack of privacy as the #3 factor preventing their institutions from being more involved onchain. #2 was regulation, which has since flipped positive. #1 was perceived risks (e.g., security and volatility), which will naturally fall over time.

Privacy is likely now the most important blocker the industry needs to address.

Privacy is the #1 area where crypto is way behind where it clearly needs to be

That’s where the next 10x improvements and 0 to 1 moments will be

Not scalability

— Jon Charbonneau 🇺🇸 (@jon_charb) August 1, 2025

It’s Finally Time for Privacy

Historically, prioritizing scalability has been the money maker in crypto. Just make a new chain that’s a little faster and cheaper. Conversely, onchain privacy has been tried for over a decade with little PMF. As a result, it’s easiest to overlook privacy if you’ve been in crypto for a while. However, the reality is privacy clearly has PMF with nearly all existing offchain finances. Outside of our bubble, it’s obvious that onchain privacy would be needed to move them over.

This is finally about to change:

This is finally about to change:

- Regulation – Historically, you’ve had to fear legal repercussions if you developed or even interacted with privacy tech. Recently though, the regulatory environment has flipped. In just the past few months, the SEC announced Project Crypto, Congress passed the GENIUS Act, the CLARITY Act has bipartisan support, the Treasury removed Tornado Cash sanctions, and Commissioner Peirce gave a staunch defense for the right to financial privacy with digital cash:

“We should take concrete steps to protect people’s ability not only to communicate privately, but to transfer value privately, as they could have done with physical coins in the days in which the Fourth Amendment was crafted.”

- Compliant Privacy – Due to a mix of ideology and technical limitations, many early attempts at privacy were incompatible with regulatory compliance (e.g., AML checks). They offered total privacy with insufficient customizability. With improved tech and increasingly product-minded builders, compliant privacy is now being built. Users need minimal and selective disclosure.

- User Profile – Onchain usage to date has frankly been largely a bunch of nerds trading shitcoins. Transparency has often been a feature (e.g., flexing NFTs, or social apps like Zora where public transactions are the whole point) or less essential (e.g., it’s just a memecoin). More tech-savvy early users can also take the time to somewhat mitigate the risks (e.g., pseudonymously managing many wallets while using CEXs as mixers). This is a radically different user profile from corporations managing their treasury, normies buying a cup of coffee, or putting grandma’s 401k onchain. These newcomers need real usable privacy by default.

Following the above, I also view privacy as a huge UX improvement. I’m one of those users managing many wallets pseudonymously. It’s exhausting constantly spinning up new wallets, using CEXs to break links, bridging funds, syncing new wallets to tax software, etc. I do this constantly to minimize the risk of doxxing my other wallets. This is true of my personal usage (especially as we get more doxxed social applications and normal consumer activity I don’t want doxxed) and professional usage (where it’s easier to tag and guess larger fund position sizes).

These attempts will also be somewhat in vain. It’s easy to slip up, and onchain analytics tools are great at tracking and linking behavior patterns. They’re only getting better.

This is frequently a blocker for me to directly conduct more activities onchain. I’m not going to split a dinner bill with friends if it means doxxing my whole financial history linked to that wallet. I’ve often ended up using TradFi rails (e.g., Venmo, Zelle) or custodial crypto rails (e.g., send via Coinbase CEX) for use cases such as this. I really just want peer-to-peer electronic cash.

Levels of Privacy

We need to clarify some important terminology now:

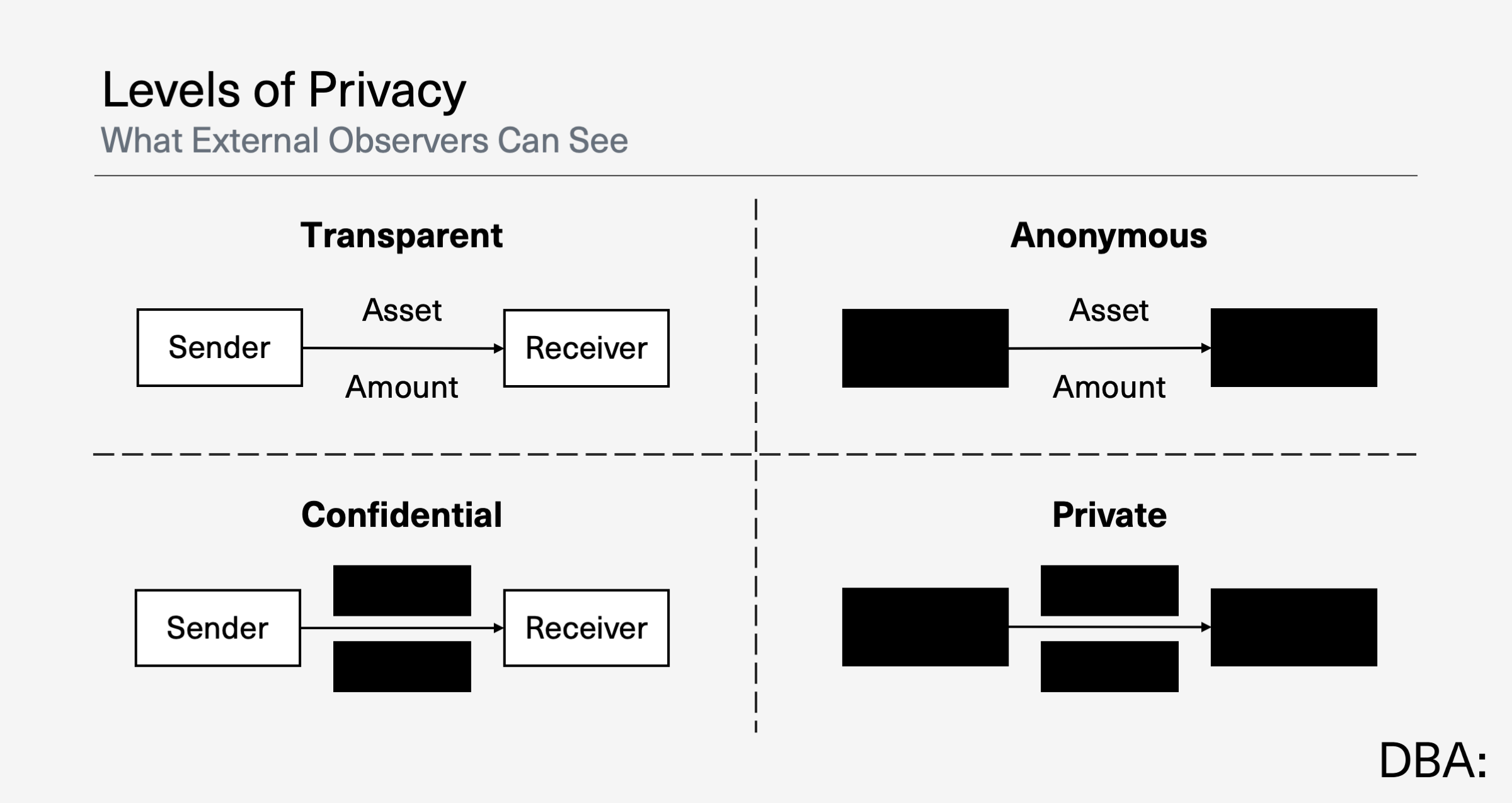

Transparent

Most onchain transactions today are fully transparent. You can look up every address’s balance, every transaction they ever made, and all of the transaction details.

Anonymous

Anonymous transactions hide the parties involved (sender and/or receiver). Transaction contents (assets and amounts) remain transparent.

Transactions hiding the parties directly involved are not commonly used. However, to a similar end, mixers provide unlinkability which obfuscates the ultimate sender and receiver across multiple transactions. For example, when you deposit into Tornado Cash, anyone can see the transaction contents and parties directly involved (you’re the sender + the Tornado Cash contract is the receiver). For withdrawals, anyone can see your address receive funds from Tornado Cash. However, outside observers cannot directly link which deposits correspond to which withdrawals from the Tornado Cash smart contract.

Confidential

Confidential transactions hide the transaction contents (asset and/or amount). The parties involved (sender and receiver) remain transparent.

Most implementations also publicize the asset involved, only hiding the amounts transacted (and resulting user balances). We see “Alice sent USDC to Bob”, but not how much USDC. This is potentially sufficient for use cases such as sending payroll to publicly known employees who are comfortable with their addresses being known.

There’s increasing experimentation in this area. For example, Solana’s token extensions enable confidential transfers, and Arc’s litepaper describes plans to provide opt-in confidential transfers via TEEs. However, there’s little adoption to date.

It’s important to emphasize the huge distinction between confidential and private. Some would even argue that chains only offering confidentiality “should stop using the word privacy as there is nothing private about anything on this chain. This is a fantastic financial surveillance tool.”

Confidentiality alone is insufficient for many (possibly most) financial use cases. It’s explicitly worse than the status quo we’re even used to offchain. Most people would never publicly broadcast the recipients of all their payments. This is most obvious in the case of embarrassing transactions (e.g., paying for OnlyFans, gambling, drugs), but it’s also clearly problematic even for normal transactions (e.g., you could use them to monitor someone’s finances and physically target them).

Private

Many use cases require true privacy where the transaction contents and parties involved are hidden. This is what we’re even used to with TradFi. The important nuance here is who this information is kept private from:

- TradFi – Transactions are kept private from regular observers, but you allow your intermediary (e.g., your bank) to see them. They ensure compliance with applicable laws, and hopefully maintain data privacy (e.g., not leaking your data).

- Crypto – Non-custodial crypto lacks the analogous intermediaries, so the required level of transaction disclosure is often less obvious. Compliant privacy will require some level of minimal (e.g., proving your funds didn’t come from a hack without revealing full transaction details to anyone) and/or selective disclosure (allowing permissioned parties to see more than regular observers).

No one approach here is strictly better than the others. The desired level of transparency or privacy will vary depending on use, and it will evolve over time. There are practical limitations here:

- Technical – Different transaction types carry differing levels of complexity in keeping them private. For example, it’s generally easier to set up private transfers than private trading. Programmability and shared state complicate things. Different flavors of cryptography (e.g., ZK, FHE, MPC, TEEs, etc.) carry their own limitations and tradeoffs. There’s no one-size-fits-all.

- Social – Technology aside, there are fundamental tradeoffs between privacy, usefulness, and threat-resistance. Total privacy sounds great for personal freedom, but it’s problematic for preventing societally undesirable actions (e.g., North Korea laundering funds from a hack). We’ll need to decide at a user level and a societal level what the right balance is in different places.

Payy

DBA invested in Payy last year because they’ve built the most usable onchain privacy we’ve ever seen. It’s even the most usable crypto app I’ve ever used, private or not, and I use it pretty much every day.

Payy is a vertically integrated onchain banking platform. They’ve built both the killer app and the purpose-built infrastructure needed to enable it:

- Payy Network is the first stablecoin chain with compliant privacy by default.

- Payy Wallet is the first non-custodial banking app built on Payy Network.

They’re both live and providing real value to thousands of users worldwide, today.

Payy’s ultimate goal is to enable everyone to be their own bank. Retain self-custody while replacing the core services of consumer banking: saving, spending, investing, and borrowing. Building it onchain makes it global and reduces overhead (which = faster and cheaper).

Payy Wallet

Private Stablecoin Payments

Payy Wallet’s first product is an app which functions like Venmo, but with all the benefits of crypto. Payy lets you save and send dollars to anyone, anywhere in the world, privately, for free, in seconds.

A key design innovation here is the ability to privately send money using traditional links sent via the platform of your choice (e.g., iMessage, Signal, Telegram, etc.). For example, the first person to click this link can privately claim $10 in seconds.

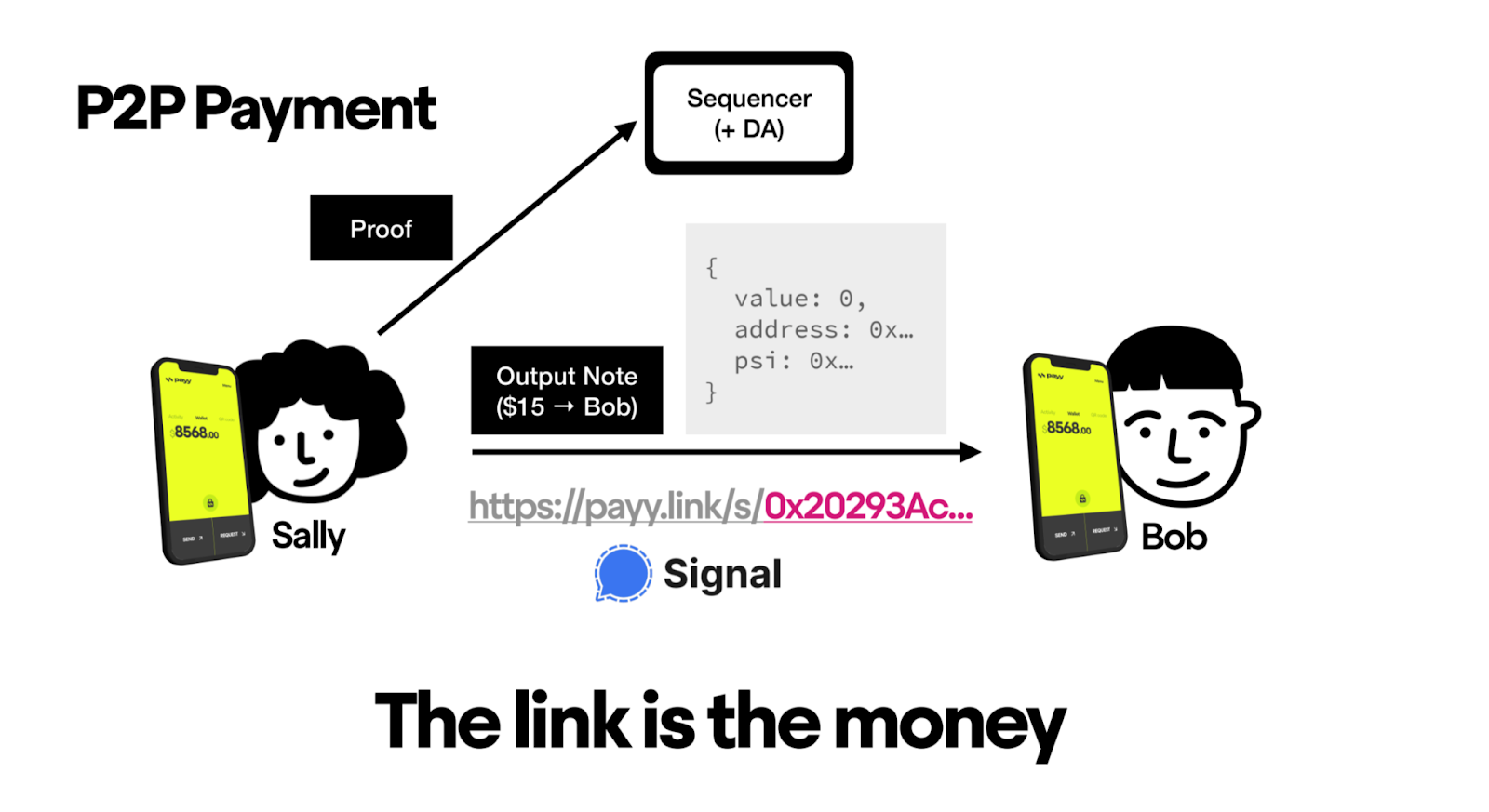

Here’s how it actually works:

- To initiate a payment, Sally generates a ZK proof on her phone proving she’s created a valid transaction. Sally sends the proof to the sequencer, but the full transaction data (e.g., sender, receiver, asset, amount) never leaves her device.

- The sequencer confirms the transaction which transfers Sally’s funds into a new ephemeral wallet.

- Payy Wallet generates a link which embeds the private key to that new wallet. Sally sends the link to Bob.

- Bob clicks the link, generating a transaction which transfers the funds from the ephemeral wallet into his own wallet.

The end-to-end flow is incredibly smooth. It takes about 10 seconds to send money to anyone:

The recipient can click the link and instantly claim the payment. If the recipient doesn’t have Payy Wallet yet, the link will just send you through the setup process first. Even then, it only takes about 20 seconds to download the app, create a wallet, and claim the payment:

This transaction flow solves the cold-start problem of creating a new payments network.

In TradFi, any setup process is inherently challenging due to KYC. Custodians and intermediaries must complete identity verification to offer you financial services. This onboarding complexity presents a meaningful adoption hurdle from the user side, and it imposes burdensome costs and time requirements on the service provider.

Non-custodial crypto services alleviate the KYC hurdle because there is no intermediary. However, a naive crypto payments setup presents equally bad (or likely worse) UX issues due to inherently fractured standards. You want to split the dinner bill, but you only have USDC on Base, your friends have USDC on Solana, and the restaurant owner is only set up to accept USDT on Tron. This problem doesn’t seem like it’s getting better.

“Can I pay you in crypto?”

“Sure, let me send you some Arc USDC”

“My wallet only works on Stripe L1”

“No problem, bridge the Arc USDC to Ethereum then swap it for Stripe USD and bridge again”

“Can I just pay with my bank?”

“Of course! Just buy some XRP to access the interbank…”— foobar/ (@0xfoobar) August 12, 2025

Payy solves both hurdles:

- Non-custodial – Easy signup. No KYC. Just download the app in seconds.

- Pay by link – Leverage existing distribution platforms to overcome the lack of shared standards. Just send a link to anyone, anywhere, and they can claim the money in seconds. Payy also allows you to pay by QR code or by sending a payment request link (the same flow as a send, just in the opposite direction).

Payy also has some other notable features which will become table stakes to win over normies:

- $USD – USDC is used under the hood today, but balances are simply displayed as $USD.

- Free transfers – There’s no notion of gas exposed to users.You don’t have to know a thing about crypto to sign up, receive dollars, and send dollars. It’s the only crypto app I routinely show to normies that they can successfully use. I can finally show my parents I have a real job. It’s simply better than TradFi products.

Payy Card

Payy recently went beyond “crypto Venmo” and launched Payy Card – the first private non-custodial stablecoin card. You can now privately spend stablecoins anywhere in the world a Visa card is accepted. It’s available digitally (e.g., in Apple Pay) and physically (plus it lights up when you tap).

Whenever you use your Payy Card, a proof is generated and a Payy Network transaction is confirmed onchain to debit the purchase amount from your Payy Wallet balance in real-time.

To be clear on the levels of privacy here:

- Payments sent via links – Fully private. The transaction sender, receiver, and amount never leave the user’s device. Everyone else (even the sequencer/prover) just sees a ZK proof and some hashes.

- Payy Card transactions – Closer to TradFi privacy. Outsiders see nothing, but the providers (e.g., Visa and Polybase Labs) still gather some key data (e.g., KYC and card payments). This is required by law. There’s no way around this while using a card for payments.

Importantly, unlike other self-custodial crypto cards, you can’t see anything from onchain data. Nobody other than the user (not even Visa or Polybase Labs) can link a user’s TradFi Visa payments data to their onchain address and activity on Payy Network, since onchain transactions are fully private.

Conversely, there are now multiple major crypto cards with completely public onchain transactions. The card providers here plainly see the users KYC data, payments data, and linked onchain history. Even public observers can link a users’ card spending to their onchain address (e.g., if you see someone making a card transaction, just check the block explorer at that timestamp). This is a very high and unnecessary risk.

Fiat Ramps

Crypto-native Payy users can easily on/off-ramp via CEXs (just send/receive Polygon USDC). Apple Pay deposits are also fast and free, but they have size limits and can’t be used to offramp. Bank transfers for Payy Wallet are live in Argentina, but most countries (e.g., the United States) don’t have this yet.

Direct ACH integrations into Payy Wallet would be more convenient even for crypto-natives, so that they don’t need CEXs. Even more importantly, the real unlock here is everyone should be able to use Payy, but normies don’t have CEX accounts. I can’t ask my 80-year-old landlord to accept my rent via Payy until she can directly off-ramp via ACH instantly and for free without knowing she’s even touching crypto. Luckily, Payy is about to launch exactly that in the United States. They’ll continue to add other countries as well. This will make the end-to-end flow seamless for anyone without ever needing to know they’re using crypto rails.

Future Products & Monetization

Payy has already replaced two of the core pillars of traditional banking – saving and spending dollars. Next, they’ll expand into investing and borrowing. They’re working on shipping yield products (e.g., US Treasuries) and adding private smart contracts for broader DeFi capability. Keep your eyes out for more to come on this very soon.

The latter also provide more compelling monetization paths. Digital cash is an amazing product for the world, but payment fees aren’t the most exciting business model. That’s why transfers are free on Payy. Taking a cut on more complex transactions (e.g., trading fees and MEV) and yield products is a proven and very profitable option.

Monetization opportunities will also grow as Payy expands into a platform model. Payy Wallet is the only app on Payy Network today, but that’s about to change. Payy Network will soon open up to outside developers, and they’re already lining up launch partners. Developers will get access to compliant privacy, a valuable user base, and even those built-in fiat ramps we just discussed via API from Polybase (and reused KYC from Payy, which is needed for fiat ramps). Projects normally need to embed individual ramps in different countries and KYC users for each ramp.

Payy Network

Purpose-Built For Private Stablecoins

Most chains today are vanilla general-purpose platforms without clear PMF. They’re unopinionated and undifferentiated.

And yet, the most successful chains are often the ones purpose-built for a specific use case. Hyperliquid optimizes for onchain trading with a small co-located validator that prioritizes cancels. Bitcoin optimizes for self-sovereign money and payments with proof-of-work and a maximally simple UTXO model.

Similarly, Payy Network is optimized to provide onchain consumer banking. Specifically, replacing banks requires building around stablecoins with privacy in mind from the start. That’s exactly what Payy Network does. It wasn’t built abstractly in a bubble. It was built side-by-side with its first-party killer app out of necessity – Payy Wallet simply wouldn’t have been possible without it.

As a result, Payy Network has a very opinionated architecture. Most notably, several of its key features mirror other privacy-focused chains (e.g., Zcash, Aztec, etc.):

- UTXO Model – While a UTXO model on its own is not privacy-preserving, building off of it is generally required to enable strong privacy. Account-based models are less amenable to privacy due to information leakage.

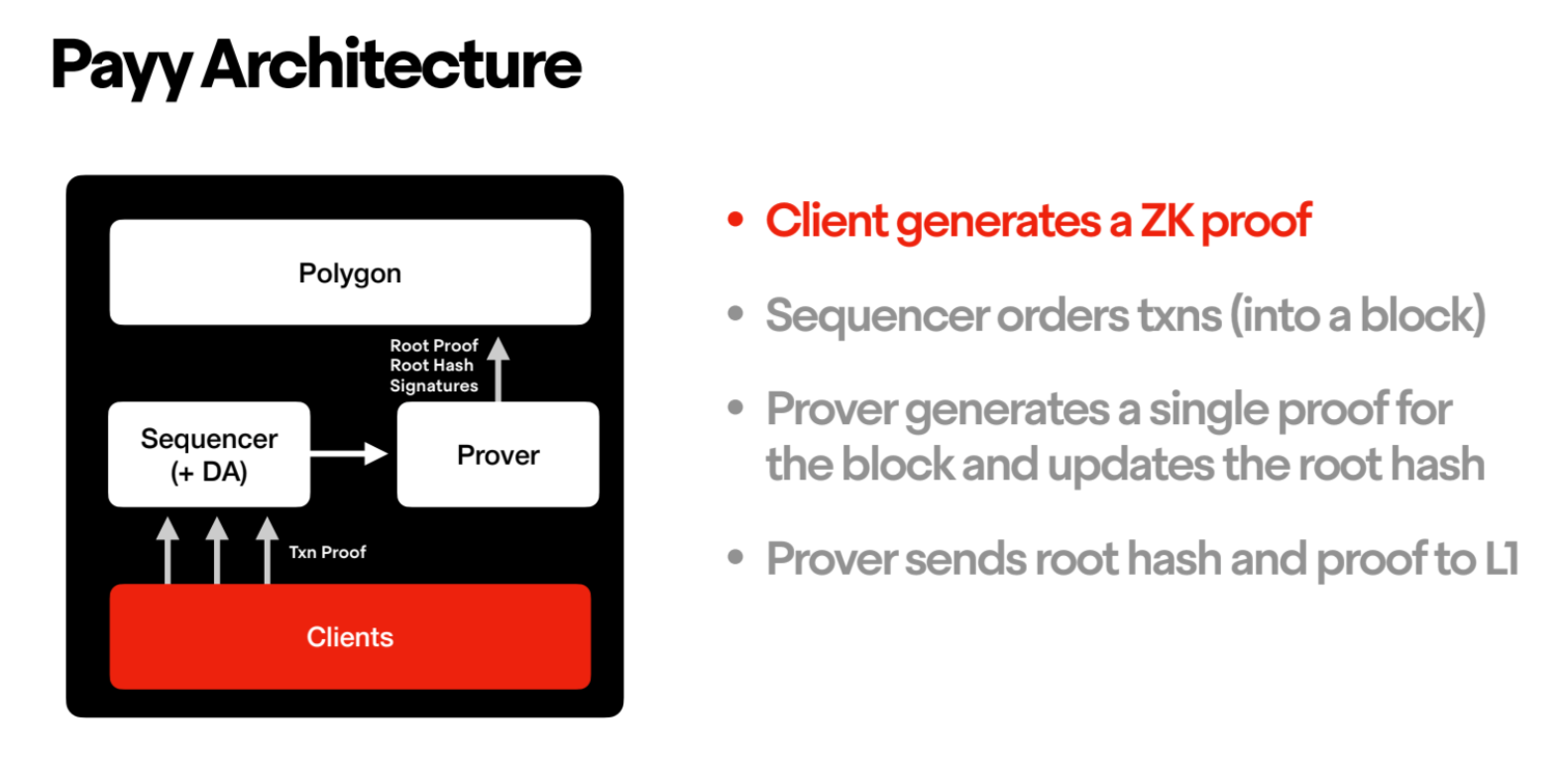

- Client-side ZK – Users generate client-side ZK proofs on their device to create fully private transactions.

Additional components include:

- Bridge – The $USD you see in the Payy Wallet is all USDC bridged via Polygon today. Polygon was initially selected for the same simple reasons Arbitrum has been a good Hyperliquid USDC bridge – it’s cheap and it has broad CEX support for USDC.

- Operator – Polybase Labs currently runs the sequencer, prover, and maintains data availability (DA). DA will switch to Celestia in the coming weeks.

Client-Side ZK

Users generate ZK proofs on their phone locally (client-side) every time they make a transaction on Payy Network. This proves they have permission to spend an input note and generate an output note without revealing all of the underlying transaction data.

In this way, Payy actually uses the “zero-knowledge” aspect of ZK proofs. This contrasts to most chains commonly referred to as “ZK-rollups” (e.g., StarkNet, ZKsync Era, Scroll) which are more accurately “validity rollups”.

Payy Network currently uses Halo2 circuits as pioneered by Zcash.

UTXO Model

Payy’s state model is UTXO-based (like Bitcoin), unlike most smart contract chains (like Ethereum) which use the account model.

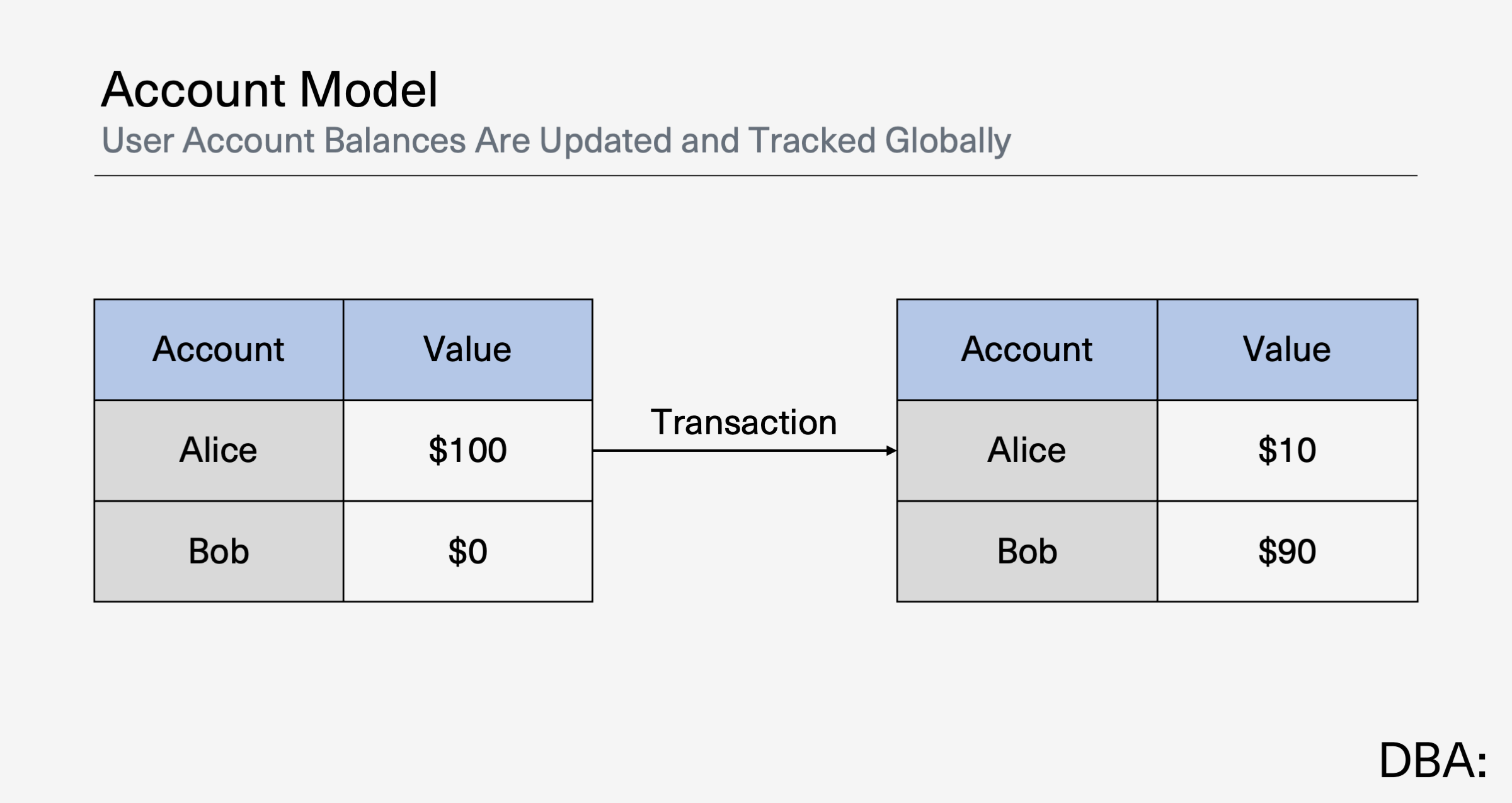

In the account model, the global state tracks the current set of accounts and their balances. Much like a bank ledger, transfers are recorded as debits and credits which modify users’ account balances (e.g., -$90 to Alice’s account and +$90 to Bob’s account).

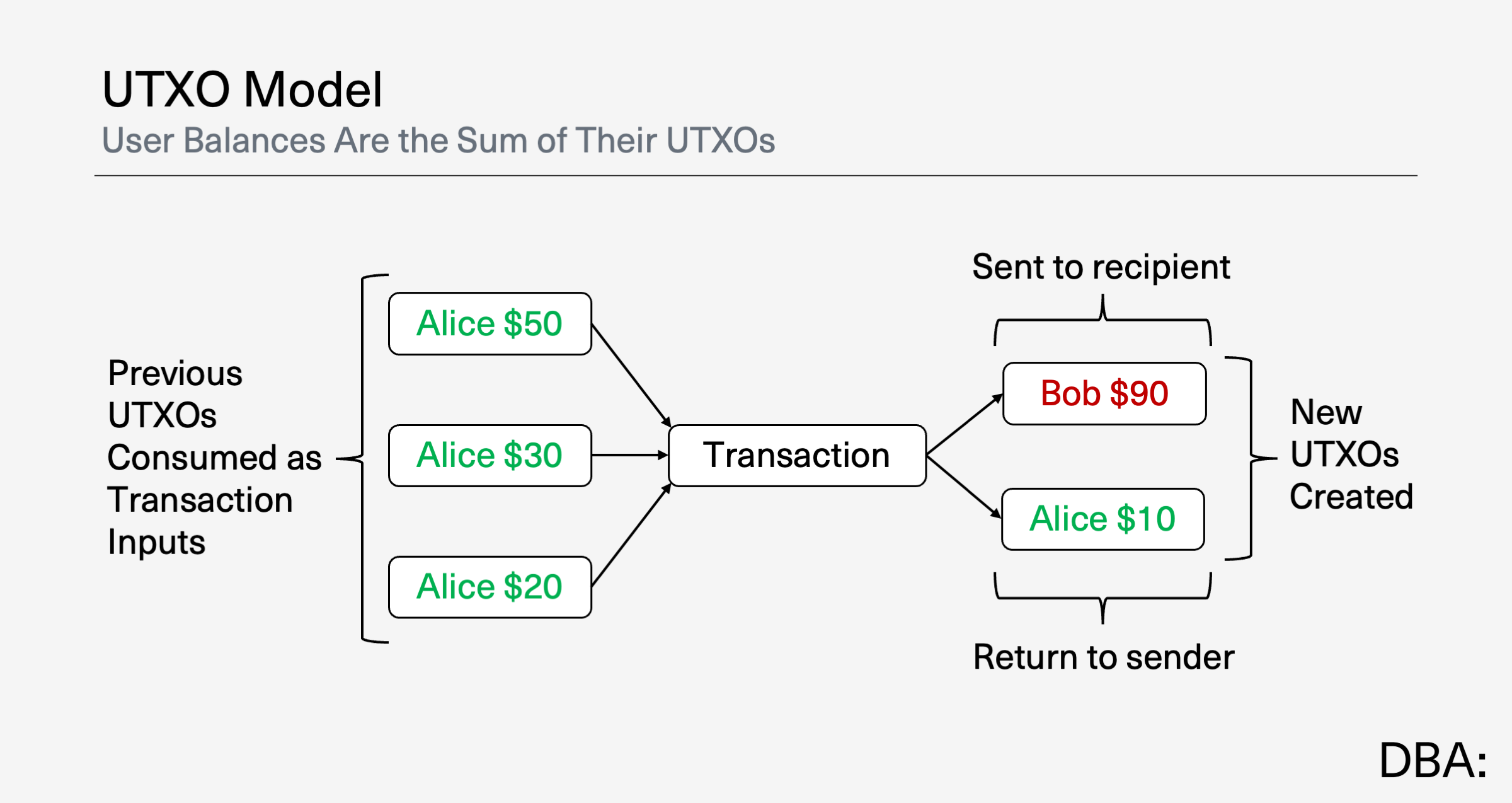

In the UTXO model, there are no global account value mappings being tracked and updated. Only individual transaction receipts are tracked.

Consider the same example where Alice sends $90 to Bob:

- Alice’s transaction references previous transactions where she received ≥$90 (in this case, $100).

- These reference transactions are consumed as “inputs,” and new “outputs” are created. In this case, one $90 output is addressed to Bob, and the other $10 output is returned to Alice as change.

- Each of these new unspent transaction outputs (UTXOs) specify an amount and a recipient. The recipient can spend them in the future (i.e., use them as inputs to another transaction). Each UTXO can only ever be spent once, and they must be spent in full.

The global state tracks the current set of UTXOs. Users calculate their balances as the sum of the UTXOs currently addressed to their public key.

As noted earlier, building off the UTXO model is generally a requirement for strong privacy. The account model creates information leakage (because you can see users’ global accounts continuously being modified) which the UTXO model does not (because users just continuously destroy and create new UTXOs).

Private Notes

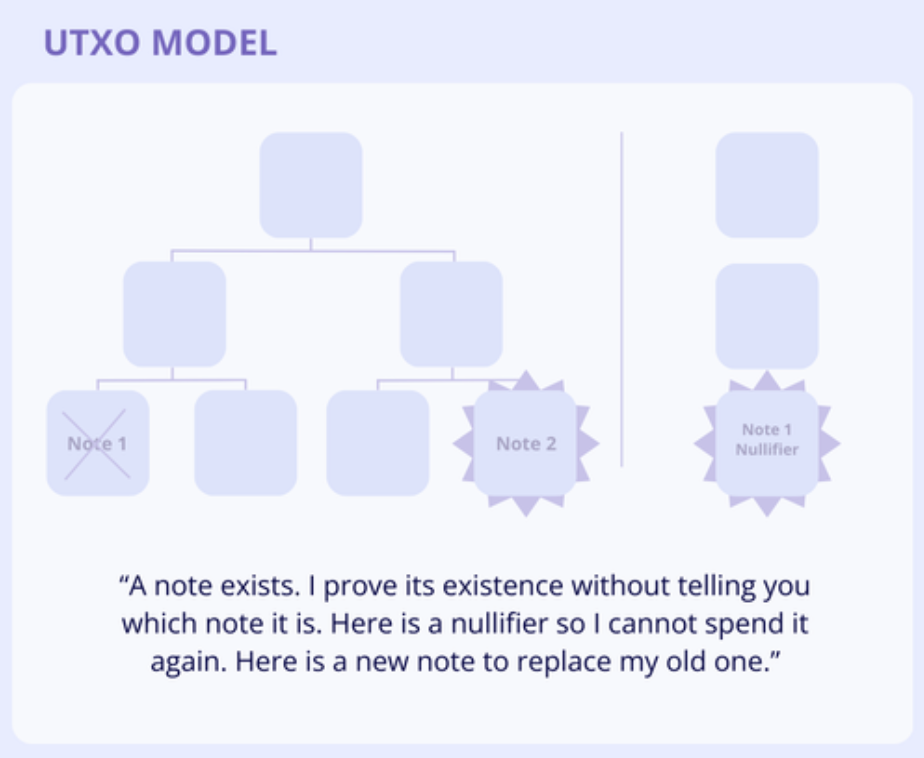

Still, we need more for privacy. That’s why private chains also use “notes,” which function similarly to typical UTXOs:

- Like UTXOs, notes specify a value and an owner who can spend them once, in full.

- Unlike UTXOs, users keep their notes private. Nodes only store a public tree of note commitments (hashes of the notes).

In transparent UTXO chains like Bitcoin, fund ownership can be verified through links to previous transactions. Anyone can see what UTXOs are consumed and created by a transaction.

However, private chains like Zcash want to hide these links. Spending a note instead requires publicly revealing its corresponding nullifier. This is a unique bit of data that can be generated for each note by its owner. Nodes all maintain the revealed nullifier set as part of the public chain state. When processing a new transaction, they check that the included nullifier is not in the existing nullifier set, thus preventing double-spending of notes.

Importantly, only the transaction sender actually knows which input note the nullifier they revealed corresponds to. Nodes validating the transaction never know which note was spent. They just know that a new note commitment (encrypted to its owner) is valid and can be added to the tree. There is no public link between the input note that was consumed and the output notes created.

Transaction Lineage

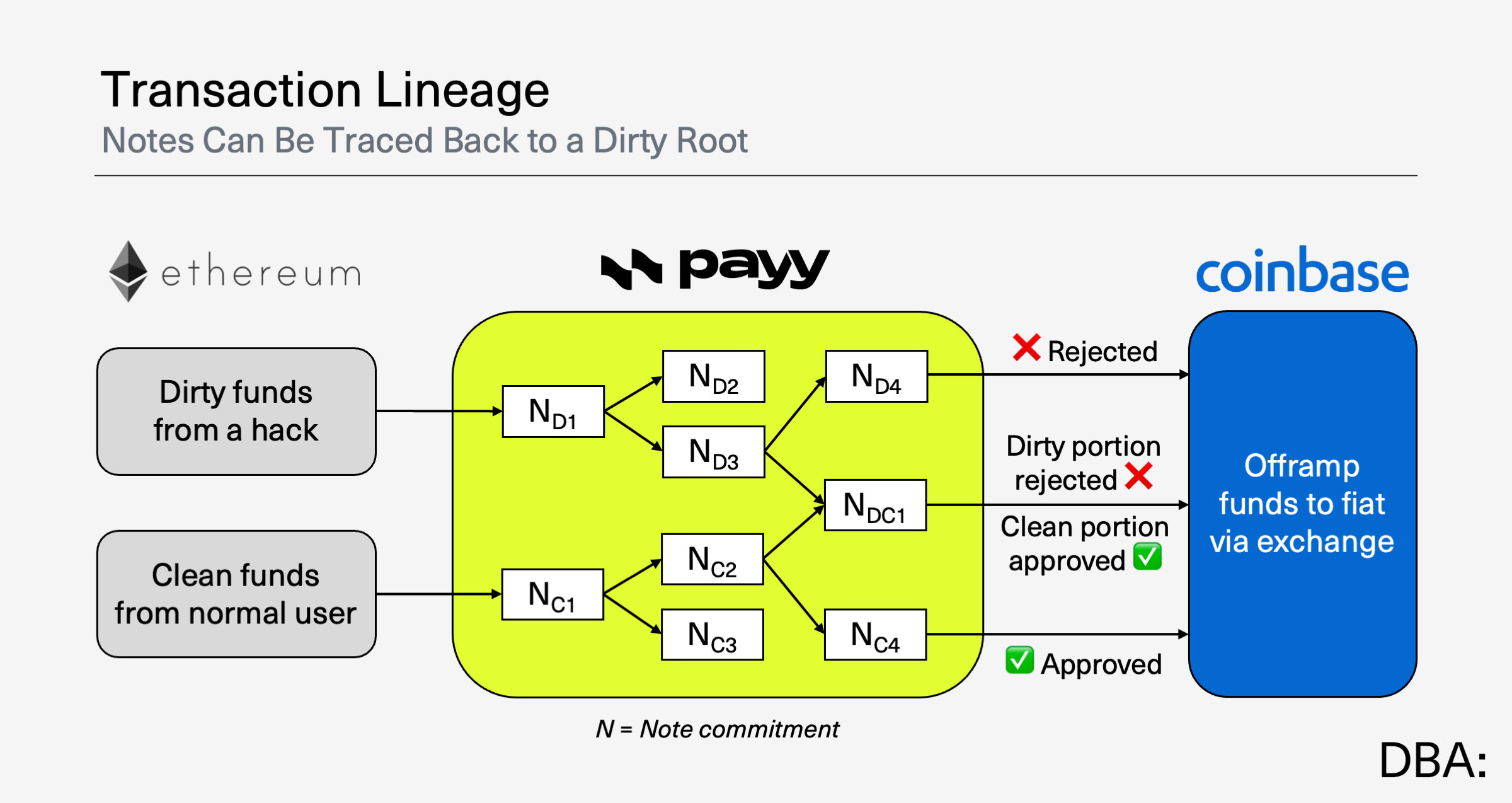

Now, how do we also ensure compliance in addition to privacy? For example, fiat offramps want to know that deposits abide by local AML laws. Payy’s answer is transaction lineage:

- Before – To spend a note, you publish its nullifier and the output note commitment. There is no public link between the input (spent) and output (created) notes.

- Transaction lineage – To spend a note, you name its corresponding note commitment and the output note commitment. The input note commitment is removed from the tree, and the output note is added. Nullifiers are no longer used, and the tree now only tracks unspent notes.

Now everyone can see the path a note takes while keeping transactions private. Users still never publicly reveal the sender, receiver, assets, or amounts involved in a transaction. The only change is that observers see a public lineage graph between note commitments (hashes).

This would enable an offramp provider to see the path a poisonous note (e.g., funded from a North Korea hack) takes through the network without needing to see transaction details along the way. Any other transaction a user does is also not linked. If a user has received a poisonous note (e.g., from being dusted), they can simply isolate it and prove which of their funds are clean. Payy Wallet will also add simple UX features to prevent innocent users from receiving bad notes (e.g., simply keeping a registry of poisonous notes which users can reject or quarantine).

User privacy is maintained, while money laundering can be traced.

This works similarly to unique serial numbers on physical cash. You can tell that a given bill came from a poisonous source (e.g., bills marked stolen from a bank heist), but you won’t see the transaction details in between (e.g., who held it in between the heist and you receiving the bill).

It’s important to stress again there’s actually no perfect answer to compliant privacy. There are fundamental technical and societal tradeoffs here. This transaction lineage design is one promising direction, but the answer will inevitably vary depending on the use case (e.g., we covered simple payments, but expect other considerations as Payy rolls out programmability), applicable regulations, and timing. The world will evolve, and so will Payy.

The Stablecoin Chain That Actually Makes Sense

Crowded Field

Stablecoin chains are all the rage lately. There’s an ever-growing list coming to market, but most of them frankly don’t make sense. They’re just new chains marketing around stablecoins. I don’t currently see any material technical unlocks or unique modifications from most of them vs. incumbent public chains (e.g., Solana, Base, Tron, Ethereum etc.).

Arc, Plasma, Stable, Codex, and Noble AppLayer are all default-public EVM chains. Most of them tout performance and stablecoin-denominated gas payments as core differentiators. However, these days “fast and cheap” is a commodity, and gas abstraction is possible pretty much everywhere.

I expect most rationally want their own chain for monetization (e.g., trying to siphon market share from incumbents like Tron) and control (e.g., having a PoA set that can roll back the chain). These are valid motivations to launch a chain, but they’re not reasons why they’ll be successful. That will require distribution and/or material technical unlocks over most existing chains. Let’s look at each here.

The most common strategy is issuer-alignment. Get an investment from Circle or Tether, build primarily around USDC or USDT, and usually pick a similar logo color. This is challenging for the Circle-aligned chains (Noble and Codex) given Circle recently IPO’d and announced they’re launching their own chain. It’s more effective for the Tether-aligned chains (Plasma and Stable) as Tether has no publicly traded asset or plans to launch a chain. Investors really want stablecoin exposure. The “stablecoin chain” was arguably even the most effective narrative for pumping ETH in quite some time. Sometimes the token is the product.

Still, hype alone is insufficient to win real activity, and I don’t see any unique tech. The primary differentiator amongst these chains is likely to be their BD competency and the market niches they choose to focus on. Existing competitors (e.g., Solana and Base) have very broad approaches where they’re trying to win everything. If these issuer-aligned chains effectively focus on a specific vertical (e.g., consumer payments ex-US, or B2B payments, or stablecoin yield generation, etc.), they may be successful there.

Next up, we have an actual issuer chain with Circle’s Arc. Again, I don’t see any material tech unlocks. Circle doesn’t really own distribution either. Its partners like Coinbase mostly do, which is why Circle has to pay them so much. Still, Circle has some interesting levers to pull at the infrastructure level such as fast fiat-to-crypto on/off-ramping, or potentially playing some interoperability role given their use of CCTP.

Lastly, Stripe’s rumored chain Tempo is interesting. While we have no technical details at this time, Stripe has strong distribution, and they’re going all in on stablecoins. It’s easy to envision how they could drive usage to their chain just from their existing services. It’s less clear how and why they might expand Tempo into new use cases.

Payy = Distribution + Tech Unlock

I believe Payy is the stablecoin chain that actually makes sense. Specifically, they have both:

- Distribution – Payy Wallet is the killer app bringing distribution. They’ve launched payments and a stablecoin card with broader financial services coming soon (e.g., Treasury yield and private DeFi). They’re live with thousands of real users and growing.

- Tech Unlock – Payy Network is the only stablecoin chain here that isn’t just another transparent EVM fork. It’s the privacy-preserving chain that’s actually optimized for stablecoin finance. You get privacy (client-side ZK + UTXO-based), compliance (transaction lineage), usability (gas abstraction), and of course scalability.

Privacy is now the primary area left to differentiate upon at the core infrastructure level here. High performance is just table stakes now. Insufficient privacy on the other hand is largely an ongoing problem in crypto which clearly needs to be addressed. Strategically, it makes sense to build for privacy as the primary goal from day one here.

And yet, these other stablecoin chains mostly treat privacy as an afterthought. This is problematic. We’ve already seen from existing default-transparent chains (e.g., Ethereum or Solana) why you can’t easily just slap on opt-in confidentiality or privacy after the fact (e.g., with Railgun or Tornado Cash). This continues to result in materially worse:

- UX – Opt-in protocols are difficult for users to reason about, and they create a clunky wallet UX.

- Privacy – Many app-layer protocols only implement confidentiality, which is often insufficient. Even when these protocols can technically offer privacy, their opt-in nature inherently reduces the anonymity set, which weakens practical privacy (e.g., even on Zcash most transactions are transparent).

- Complexity – Pushing this outside of the core protocol inherently creates new layers of complex and fragmented infrastructure.

- Compliance – Uniform privacy technology enabled at the core protocol level allows everyone to abide by shared standards which can be adopted and integrated.

Stablecoin chains launching without fleshed out privacy from the start will run into these roadblocks. There are some great teams trying to bring usable privacy to default-transparent chains, and I’m excited to see them progress, but it’s simply not there yet today.

This lack of privacy is likely to be even more problematic for stablecoin chains than most incumbents as well. The level of privacy needed is always use case dependent, and as we discussed earlier, it’s often most applicable for institutional and normie consumer use cases which already have privacy today in TradFi. They’re not going to move over if they lose privacy on the way. Given that’s largely the target market for stablecoin usage, privacy is naturally of heightened importance. Payy is the only stablecoin chain built with default privacy as a core feature from day one.

Lastly, we should also note the long list of other privacy-focused chains (e.g., Zcash, Monero, Aztec, Miden, Aleo, Penumbra, Namada, Secret Network, etc.). Many of them are doing absolutely incredible technical work that I’m once again excited to see progress. Payy’s technical distinctions here are often much smaller than vs. the aforementioned “stablecoin chains.” Here, Payy’s critical distinction is the fact that only they are bringing a first-party killer app with a stablecoin-focused go-to-market strategy. This is becoming increasingly important in an industry oversupplied by general-purpose infrastructure.

Payy’s strategic progression here most closely resembles that of Hyperliquid:

- Build your own minimum-viable chain that’s purpose-built for your first-party killer app, because it’s needed to make it possible.

- Win distribution on your killer app.

- Progressively turn the network into a platform model, opening up to outside developers, building out the tech to support more use cases, and decentralizing operations.

We’ve seen clearly why this is such a strong playbook.

Conclusion

I’m mostly excited about Payy for a very simple reason – I actually use it all the time.

I say this as someone fortunate enough to be in the top percentile of financial accessibility – an American citizen living in NYC. Even here, life would simply be better if I could move more of my finances onchain. For example:

- Sending a wire transfer will make anyone a crypto maxi.

- Zelle has daily limits of a few hundred to a few thousand dollars depending on your bank, as well as monthly limits (I’m getting pretty tired of sending my rent in pieces over multiple days).

- Venmo routinely deplatforms and blacklists users for what they deem to be undesirable activity (I have friends here).

- I bought a car recently and found out what cashier’s checks are – insane concept.

- Less KYC = less data leaks. Myself and many others I know all somehow happened to be in the “<1%” of Coinbase customers with sensitive data leaked.

The list goes on. For the vast majority of the world, the list is much longer with orders of magnitude higher impact. It’s not just about solving inconveniences. It’s providing core financial services to people who would otherwise simply not have access. Payy solves real problems for real people.

Digital cash is the killer app of crypto. We shouldn’t have to sacrifice the great properties of physical cash to go digital, and we certainly won’t move people onchain if it’s actively worse than TradFi on these properties. That’s why it’s clear to me that privacy is coming in a big way in crypto. It will be a key issue as the industry competes for more serious usage.

The real question is how privacy will be implemented. There is a realistic path where privacy is primarily enforced by trusted intermediaries who just use blockchains for backend operations. You keep your money with a custodian like Coinbase, and they manage user funds together in an omnibus account. You’ll mostly just see Coinbase master wallets being used onchain.

While I think this model clearly has a place, I also believe that we will see real digital cash, offering users self-custody and privacy, at scale. Users want the lower fees, simplicity, and sovereignty that this model offers. Service providers want the structurally lower costs and operational overhead, increased speed of delivering products, and reduced data liability.

To enable this, we need digital cash with the privacy of physical cash and the usability of TradFi. Payy is building the killer apps and infrastructure required to deliver exactly that. They were building a “stablecoin chain” years before they were cool, because they needed to build one from first principles to make their use case possible. Looking ahead, innovation will continue to be needed. User demands and regulations around privacy will change. The industry will need to adapt. I believe Payy will continue to be ahead of the curve delivering across the stack.

Disclaimer: The views and opinions expressed herein are the personal views of the respective author(s), do not necessarily represent the views of DBA Asset Management, LLC (“DBA”) or its personnel or affiliates, and are subject to change at any time without notice or any update hereto. This post is made available for informational purposes only as of the date of publication or as otherwise provided and should not be interpreted as investment, financial, legal or other advice or an endorsement, offer or solicitation of any kind. Investing involves risk. You are strongly encouraged to consult your own advisors. Some information contained herein may be sourced from third parties, including portfolio companies of investment funds managed by DBA. While the author(s) believe(s) these sources are reliable as of the date of publication or as otherwise provided, they do not independently verify such information and make no representations regarding its present or future accuracy, completeness or appropriateness. For further disclosures see: https://dba.xyz/disclosures/.