Thank you to Comfy Capital and Felipe Montealegre for valuable feedback and review.

The views expressed in this post are solely those of the co-authors, and do not necessarily reflect those of the reviewers.

Summary

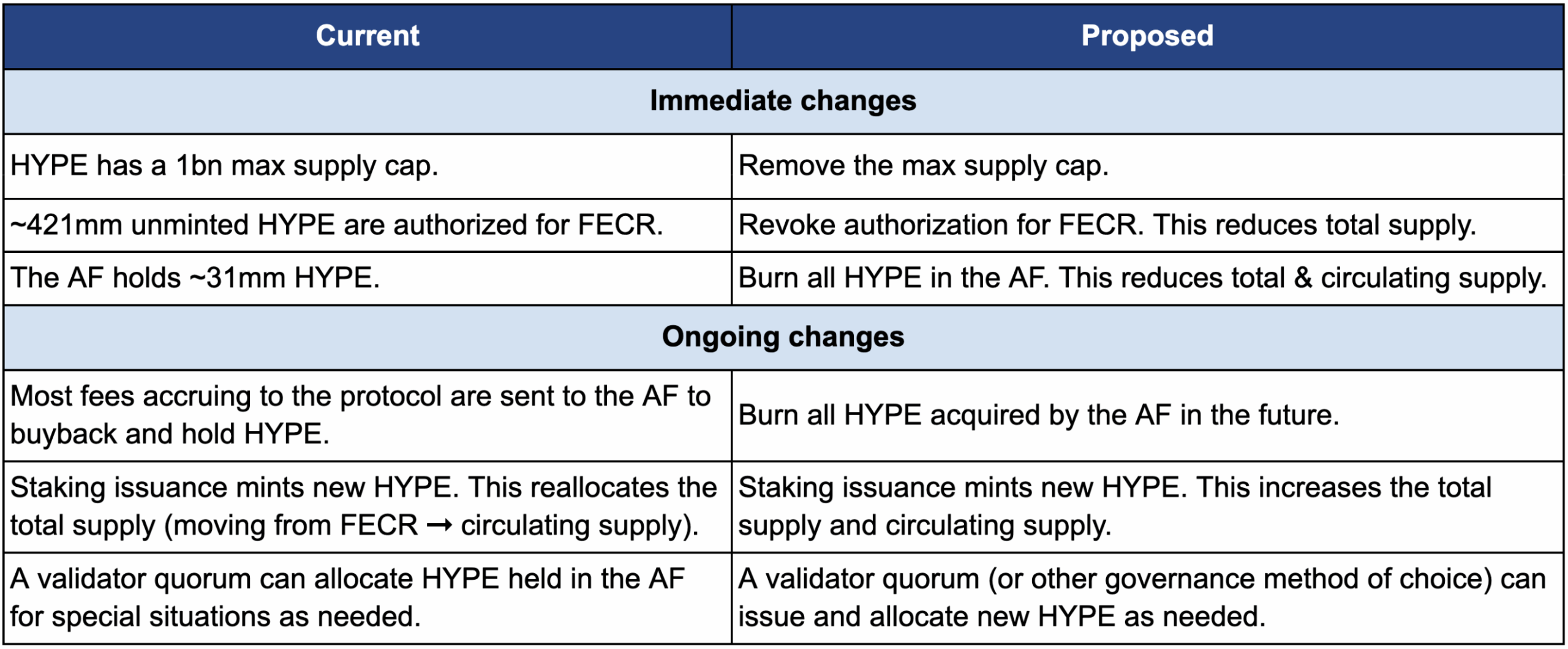

We propose the following changes to Hyperliquid’s economic model:

- Future Emissions & Community Rewards (FECR) – Revoke authorization for all unminted HYPE currently allocated to FECR.

- Assistance Fund (AF) – Burn all HYPE currently held in the AF. Burn all HYPE acquired by the AF on an ongoing basis.

- Max Supply – Remove the max supply cap of 1bn HYPE. Ongoing token issuance (e.g., for staking emissions or community rewards) would now increase the total supply.

The result is an immediate >45% reduction in HYPE’s total supply.

Hyperliquid currently has a large amount of authorized non-outstanding supply between the AF (~31mm HYPE) and FECR (~421mm HYPE). This is problematic because the market penalizes this excess supply in valuing the protocol, and pre-allocating these tokens may unduly bias future capital allocation decisions. Our proposal addresses these issues by better aligning Hyperliquid’s financial accounting with its underlying strategy.

Importantly, this proposal has no impact on existing HYPE token holders’ relative ownership of protocol economics, Hyperliquid’s ability to fund value accretive initiatives, or how these decisions are made.

Problem

HYPE Has Excess Authorized Non-outstanding Supply

For background, HYPE’s genesis and current token distributions are as follows:

Source: Hyperliquid Economics

The Market Penalizes Excess Supply

Crypto valuation metrics are a mess. They’re inconsistent with TradFi equity accounting standards, and they’re even measured inconsistently across data providers. The most popular circulating market capitalization (MCAP) and fully diluted valuation (FDV) metrics are usually misleading, with the most relevant figure somewhere in between:

- MCAPs are too low, excluding team and investor tokens with known plans to enter circulation (i.e., scheduled unlocks).

- FDVs are too high, including tokens which are authorized but have no plans to enter circulation.

There are already plenty of posts out there describing this issue and proposing new metrics, so we’ll keep it simple here and highlight the direct issue for Hyperliquid. Standard FDV calculations wildly exceed what we consider to be reasonable measures of HYPE’s current valuation and supply.

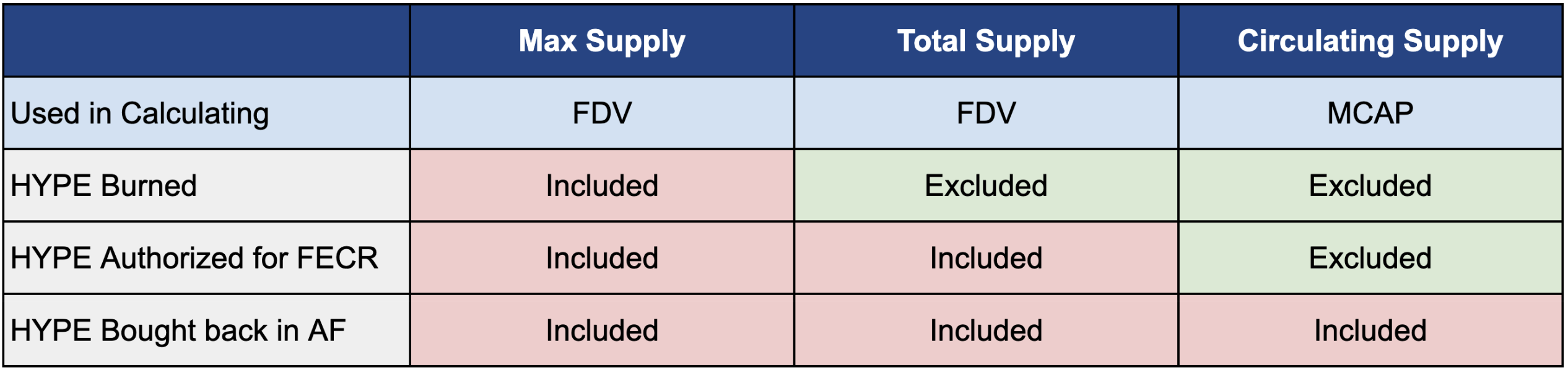

Most platforms, such as CoinMarketCap, default to max supply for calculating FDV:

“The market cap if the max supply was in circulation. Fully-diluted value (FDV) = price x max supply. If max supply is null, FDV = price x total supply.”

This FDV always uses HYPE’s max supply of 1 billion tokens even when HYPE is burned (e.g., from HYPE spot trading fees). Other providers such as CoinGecko default to calculating FDV based on total supply, so burned tokens do at least reduce the FDV there.

Providers also consistently count HYPE buybacks held in the AF within circulating supply, so they don’t reduce the FDV or the circulating MCAP. Additionally, they consistently count the FECR within total supply, so that always increases the FDV.

Overall, crypto data providers consistently show the following:

We personally model outstanding token supply for valuation purposes very differently:

- Include tokens with known allocation and unlock schedules (e.g., vesting insider allocations).

- Exclude tokens without plans to enter the outstanding supply. This includes tokens held in treasury (e.g., AF) or other authorized and unissued tokens (e.g., FECR). In equity terminology, these are akin to treasury shares and authorized unissued shares, which do not count towards outstanding supply.

Further, we project forward and count tokens which we estimate will enter circulation, even though they have some uncertainty (e.g., HYPE staking issuance and potentially some community rewards). We then project our estimated offsetting value directly received as a holder (i.e., if you stake to receive issuance, you’re not being diluted anymore) and other value created for the protocol (i.e., tokens issued should generate proportional or greater value in expectation, such as users paying more fees).

There are plenty of great investors out there who also use similar supply modeling and valuation processes. However, the reality is that many (possibly even most) do not. We routinely have these conversations with other investors, and many (including some of the biggest and most sophisticated funds) routinely just use the headline FDV for HYPE and other tokens. We believe that’s misleading, and we hope industry standards will improve over time, but that’s the reality.

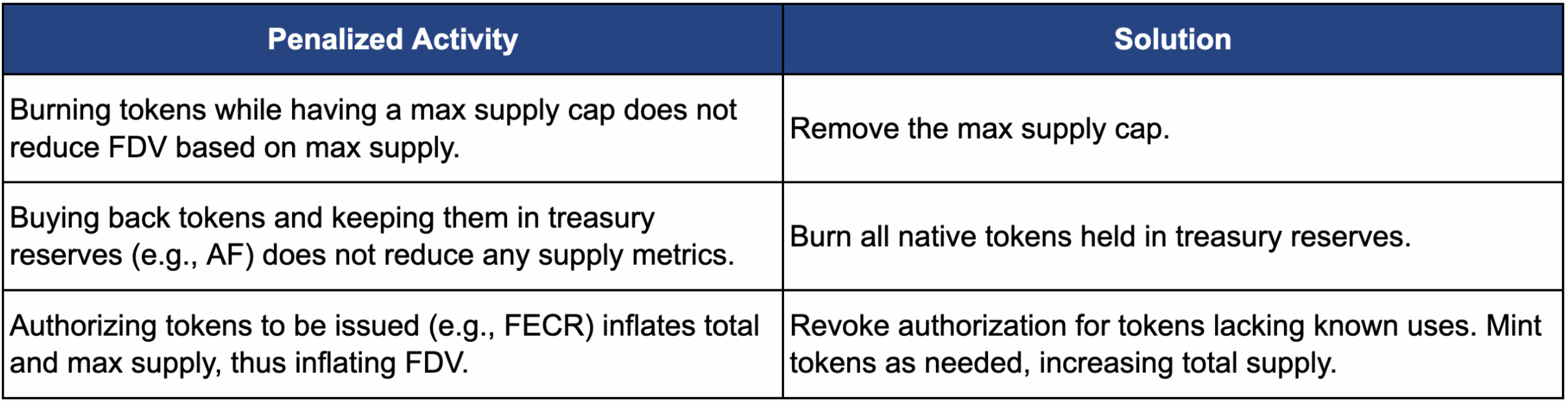

The widespread use of these misleading valuation metrics directly results in misvalued tokens. In particular, they penalize protocols which conduct these activities:

Given HYPE’s current supply dynamics, it’s one of the most unfairly penalized tokens on the market today. It stands to benefit heavily from remedying this.

Proposal

As such, we propose modifying Hyperliquid’s economic model as follows:

Our motivation is twofold:

- Increase legibility of protocol economics to outsiders considering whether to participate. This enables the market to more accurately value the protocol (e.g., misleadingly high FDV metrics turn many investors away). This expands the Hyperliquid ecosystem by attracting new participants (many come first as investors) and increasing the resources available to grow it (i.e., more investors deploying capital).

- Increase legibility of protocol economics to community members, allowing them to make more informed capital allocation decisions. Pre-allocating tokens to specific buckets psychologically biases many people towards using those funds, rather than evaluating all incremental capital uses based purely on direct economics (e.g., will dilution and issuance of $X of tokens result in $Y>$X of value creation down the line?).

These changes have no impact on existing HYPE token holders’ relative ownership of protocol economics, Hyperliquid’s ability to fund value accretive initiatives, or how these decisions are made. They’re simply bookkeeping changes which better align Hyperliquid’s financial accounting with its underlying strategy and goals.

As a result, we view these changes as strictly positive optionality. For example, consider the possible scenario where this proposal is enacted, and it has a positive impact on HYPE’s market value. If Hyperliquid then runs an incentive campaign using newly issued HYPE rewards, it would now need to distribute less HYPE to achieve the same economic impact as before.

We typically see two counter-arguments to the proposal here:

- The onus is on the market and governance to be smarter in their understanding of Hyperliquid’s economics, so no changes are needed.

- Hyperliquid is in an early stage growth mode, so funds should be used liberally for growth rather than burned.

Regarding the first point, we believe the onus is always on the protocol to accurately convey its story to the market. Outsiders have finite time and resources to evaluate them. They’ll always gravitate to widely used metrics which allow for easy direct comparisons (e.g., to compare P/E multiples). The reality is that industry standards penalize Hyperliquid’s current economics, and this is unlikely to change any time soon. The market is never perfectly rational.

Regarding the second point, this is a false dichotomy. This proposal is in no way mutually exclusive with future growth initiatives. New HYPE can just as easily come from newly approved issuance rather than allocations from the AF or FECR. The proposal here just provides a more accurate accounting of this reality.

Max supply caps are mostly a vestige of BTC’s famous 21mm cap. However, this cap is not reflective of reality in most other cases. A supply cap is simply a representation of the current social consensus and expectations around it. If everyone decided tomorrow that BTC should have a 22mm cap and HYPE should have a 2bn cap, both would fork. BTC’s 21mm cap makes sense because there’s actually a strong social contract that it will never change.

This is not the case for HYPE (and just about every other token). If many years down the road the FECR had been exhausted, but there were value accretive opportunities requiring additional HYPE issuance, the community would very likely all be in favor of this. There’s no religious tie to an arbitrary supply cap here. This is why other major tokens such as ETH and SOL have no supply cap. They simply issue new tokens and increase supply as they go.

Even aside from Hyperliquid, we believe this is a trend we will increasingly see across the industry. Several other protocols have recently burned excessive treasury reserves and migrated tokens to enable issuance beyond their initial hard cap (noting HYPE can avoid a complex manual migration given it’s an L1 capable of forking). This is just rational accounting. They’re turning a market disadvantage into an advantage.

Overall, we believe this proposal offers material economic benefits to Hyperliquid with little to no downside.

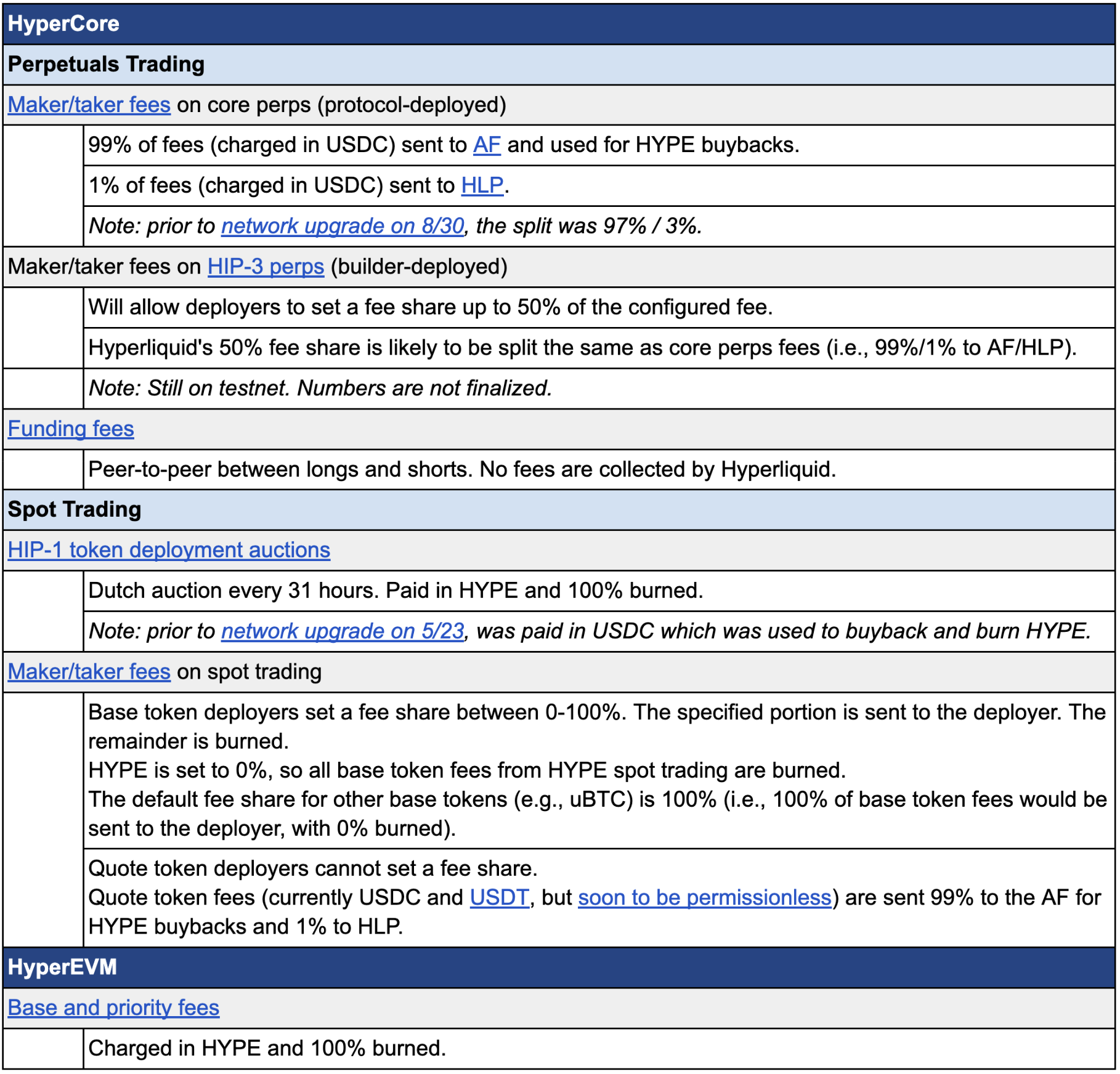

Appendix – Current Hyperliquid Fee Model

All Hyperliquid fees are currently directed to the community as follows:

Source: Hyperliquid Economics

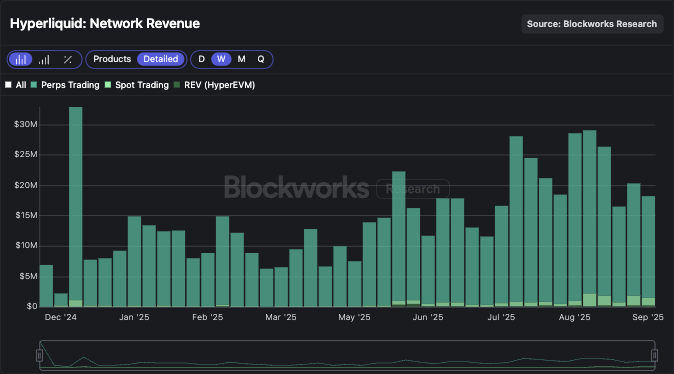

HyperCore trading fees provide nearly all protocol revenue today. Perps fees are the majority (>90%), spot fees are meaningful but much smaller (<10%), and ticker auction fees are a negligible share (averaging tens of thousands of dollars per day). HyperEVM revenue is similarly relatively small.

This revenue composition will evolve over time with potential new revenue streams including yield sharing from permissionless aligned stablecoins (e.g., USDH), HIP-3 perps fees, and HIP-4 event markets.

Disclaimer: Jon Charbonneau is a Manager of the investment manager DBA Asset Management, LLC (“DBA”). One or more of the investment funds managed by DBA hold(s) a material position in the HYPE token, as do both of the co-authors personally. Should this proposal come up for a formal governance vote in which DBA, its affiliate(s) and/or the co-authors are able to participate, all currently intend to vote in favor thereof, as applicable. The views and opinions expressed herein are the personal views of the respective author(s), do not necessarily represent the views of DBA or its personnel or affiliates, and are subject to change at any time without notice or any update hereto. This post is made available for informational purposes only as of the date of publication or as otherwise provided and should not be interpreted as investment, financial, legal or other advice or an endorsement, offer or solicitation of any kind. Investing involves risk. You are strongly encouraged to consult your own advisors. Some information contained herein may be sourced from third parties, including portfolio companies of investment funds managed by DBA. While the author(s) believe(s) these sources are reliable as of the date of publication or as otherwise provided, they do not independently verify such information and make no representations regarding its present or future accuracy, completeness or appropriateness. For further disclosures see: https://dba.xyz/disclosures/.