Thank you to Felipe Montealegre and Mike Ippolito for valuable feedback and review.

The views expressed in this post are solely my own, and do not necessarily reflect those of the reviewers.

Introduction

Crypto’s latest metagames – the revenue meta and the DAT meta – highlight the two opposite approaches to investing:

- Fundamental investing – Buying an asset because you expect to capture an economically quantifiable benefit (e.g., cash yield, consumption utility, or monetary utility) under a set of explicit assumptions. These benefits create an intrinsic value for the asset.

- Greater fool investing – Buying an asset solely because you believe someone else will buy it from you later at a higher price (even if market price > intrinsic value).

Put another way, are you betting primarily on fundamentals or flows? This short post provides a simple framework to understand the value of each.

Fundamentals vs. Flows

It’s All About the Future

Fundamental investing is often seen as less risky and less volatile vs. betting purely on flows:

- Less downside – Fundamental investors often avoid the biggest losers. You should get some downside protection due to the intrinsic value of your asset. This may be reflected in the asset’s market price or its ability to generate cashflows for you.

- Less upside – Fundamental investors often miss the biggest winners. You’ll miss out on purely speculative investments altogether (e.g., the 1000x memecoins) and often sell your fundamental positions too early (e.g., before they trade at peak multiples).

While the above tends to be the case on the margin, both investing styles ultimately rely on predicting the future, and your predictions can always be right or wrong. You’re betting on future fundamentals (e.g., I believe protocol X will generate $Y income next year) and future flows (e.g., I believe token X will receive $Y in net buyer inflows next year).

What ultimately matters in both cases then is how confidently you can make these predictions. In practice, fundamental investing just more often lends itself to making confident projections. For example:

- Fundamentals – You can observe a business like Tether or a protocol like Hyperliquid consistently generating high income. Coupled with an understanding of the core business, you can use this to reasonably forecast future cashflows. A strong project shouldn’t lose all of its customers or revenue overnight, and ideally they should grow.

- Flows – I don’t see much edge to be had (outside of insider trading) in betting on how far the DAT mania will run. It could lose steam tomorrow or in a year. I really don’t know.

Growth vs. Value

“Fundamentals” don’t mean boring or low returns. You can hit massive winners by betting purely on fundamentals. In these cases, you’re usually just betting more heavily on future fundamentals improving (i.e., growth investing) rather than present fundamentals continuing (i.e., value investing). Betting on high future growth usually means higher risk (i.e., making lower confidence predictions) for which you expect to be compensated with higher returns.

It’s also a spectrum. Growth vs. value investing isn’t binary. Given that crypto is primarily early-stage investing, most fundamental investing here is more biased towards growth than value.

An asset that loses money today but has high growth potential can be a better fundamental investment than an asset that’s profitable today but has lower growth potential (and may even have shrinking profitability). Would you rather own OpenAI or ETH? This continues to confuse many crypto participants that a high P/E investment can actually be a fundamental investment. This is the important distinction:

- Fundamental Investing – You expect that this protocol has the potential for very high future growth. This can translate to high future earnings (and thus a lower P/E multiple in the future).

- Greater Fool Investing – You have no expectation that growth or earnings will come. You’re just hoping someone else will buy it from you at an even higher multiple.

Fundamentals-Driven vs. DAT-Driven

The result of all this is I continue to generally prefer holding underlying assets with sound fundamentals. This includes mature projects with strong current fundamentals that I expect to persist, as well as early-stage projects with the potential for high future growth in fundamentals.

Conversely, we have not participated in any DATs to date (though I’m open to their value proposition in certain circumstances). I’m similarly hesitant to purchase underlying assets where the thesis is almost entirely reliant on DAT flows rather than strong fundamentals. Whenever the DAT mania ceases, the floor can quickly fall out on these assets. I view this as a primarily flows-driven speculative trend where I personally see little alpha to be generated. Invest where you have some edge. Besides, DATs can buy assets with strong fundamentals too.

Reducing Reliance on Human Psychology

Buffett vs. BTC

The ability to confidently make predictions is often inversely correlated with the degree to which the outcome is reliant upon assumptions around unpredictable human psychology and behavior.

The whole point of fundamental investing is that you don’t need other people to agree with you. The simple test is “would you hold this asset even if you could never sell it?” Warren Buffett doesn’t need the market to agree with him. He buys equities which are capable of generating sufficient cashflows to pay back his investment plus some rate of return.

- BTC – Buffett famously wouldn’t buy all the bitcoin in the world for $25 because it produces no income for its holder. It’s only useful if you can sell it to someone else.

- Apple equity – Conversely, anyone would happily buy all $AAPL shares for $25 even if you could never sell them. That’s because Apple is capable of generating $25 of income in milliseconds.

Obviously fundamental investors usually can sell assets, but at minimum they’re buying an asset with the understanding that its market value can diverge from its intrinsic value for long periods. They’re happy to hold through that. At the extreme end, they’ll tell you that if you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.

Fundamental investors still consider human behavior to the extent that it influences predicting an asset’s future income (e.g., will people continue to pay for this protocol’s product?). However, they do not have to make an additional, often much more difficult, leap of faith that other people will agree with their thesis and buy their asset as well. It’s often difficult to predict the market’s reaction even if the asset clearly derives value from selling the product (i.e., the market can remain irrational and underprice assets with strong fundamentals for long periods), and it’s even far harder to predict the market’s reaction when the asset does not clearly derive value from selling the product (e.g., a loosely associated memecoin).

Even when investing based on flows, you can still increase the confidence in your projections by minimizing your reliance upon human psychology. For example, rather than relying purely on narrative-driven sentiment predictions, you can project sell flows by quantifying token emissions, investor tax liabilities, investor unlock schedules, and unrealized profit held by investors.

Additionally, recognizing certain long-term behavioral patterns can help reduce uncertainty. For example, humans have held gold as a store-of-value (SoV) for thousands of years now. It’s possible that everyone wakes up tomorrow and decides that gold is worth no more than its strict utility value, but that seems highly unlikely. This generally isn’t your biggest risk if you’re holding gold.

BTC, ETH, & Memecoins

Similarly, the past 16 years of BTC’s ascent have given us increasing confidence in when and why people will buy BTC. This helps us to reduce our investment reliance on human psychology (e.g., will people buy BTC if global liquidity increases?) and increase our reliance on other underlying investment theses that we may actually want to bet on (e.g., will global liquidity continue to increase?). As a result, BTC is perhaps the investment that most crypto investors have the highest confidence in, even though it’s a very flows-based investment.

This also helps us to understand why the ETH investment case is inherently more complex – it requires taking more leaps of faith around human behavior and market psychology. Most investors generally agree that ETH won’t produce the cashflows needed to justify its valuation on fundamentals alone. Rather, its continued success would more likely result from becoming a durable SoV (more like BTC). This requires making some combination of the following predictions:

- Multiple crypto SoVs – You could predict that people will start to assign a relatively higher SoV premium beyond the top asset (BTC) to others such as ETH. BTC becomes less special. However, we don’t see this treatment today, and historically we’ve seen people gravitate towards one asset within a vertical for this function (e.g., gold is mostly priced on monetary value, and silver is mostly priced on utility value).

- Replace BTC as SoV – You could predict that BTC will eventually fail (e.g., due to security budget concerns or quantum computing), and ETH would be the natural successor as digital gold. However, it’s very possible that every crypto asset would just fall due to the loss in confidence.

- SoV tied to certain utility – ETH’s thesis is usually tied to the additional utility that Ethereum provides over Bitcoin. This is measured by a variety of metrics such as value “secured”, EVM activity, ”L2” activity, or DeFi usage. However, unlike cashflows due to ETH (i.e., REV), these metrics provide no intrinsic value. They’re SoV stories. The result is that ETH is far from a pure expression of an underlying thesis that those network-level metrics will increase. You’re betting heavily on those trends and how you believe the market will price ETH as a result.

To be clear, there’s nothing inherently wrong with making any of these bets. It required a similar leap of faith around human behavior to buy BTC in 2009. That worked out quite well. Investors just need to be aware of what exactly they’re betting on, and where their views diverge from market consensus. Generating repeatable alpha requires understanding where is the market wrong?

All the way out on the spectrum, you also have pure memecoins with no illusion of durable monetary premium. You’re betting entirely on human psychology and how the market will react short-term to new narratives. Is this meme exciting, funny, boring? It’s a game of chicken.

Conclusion

There’s nothing inherently wrong with either investment approach we discussed here. What matters as an investor is your ability to systematically make confident predictions using them. Making higher confidence predictions can lower your volatility and downside. Making more confident predictions relative to the market consensus can help you produce alpha. Do whatever you have a repeatable edge at.

More often than not, especially for longer-term investments, I find myself better able to reproduce alpha with theses that are more reliant on fundamentals. As noted though, this isn’t always strictly the case. Investments such as BTC can straddle the line of “fundamental investing” and “greater fool investing” depending on how you quantify monetary utility. You can have high confidence betting on BTC based mostly on flows, and low confidence betting on a DeFi project based mostly on fundamentals if its current earnings could disappear in a bear market.

Finally, the approaches described here are not mutually exclusive. You can invest based on both fundamentals and flows, and indeed the best risk-adjusted investments are often a byproduct of exactly that.

Historically, it has paid off to be primarily flows-driven as a crypto investor. This made sense when tokens would all rip every four years for no good reason, interest rates were 0%, investors raised too much money, and few projects could actually generate cashflows to justify the high valuations. Looking forward though, I believe that focusing more on fundamentals (at least relatively more than most crypto investors do today) could finally produce more alpha as the industry matures.

I also hope that fundamentals become more important, because it’s necessary for the industry’s long-term health. I’ve got nothing against memecoins (they’re mostly just fun gambling), but narrative trading around assets which don’t create value is an inherently zero sum game. Conversely, allocating capital to projects capable of generating cashflows can be a positive sum game. Building a project that generates cashflows requires creating a product that customers derive value from (that’s why they’re willing to pay for it). Building a token to sell based purely on narrative has no such requirement. The token is the product.

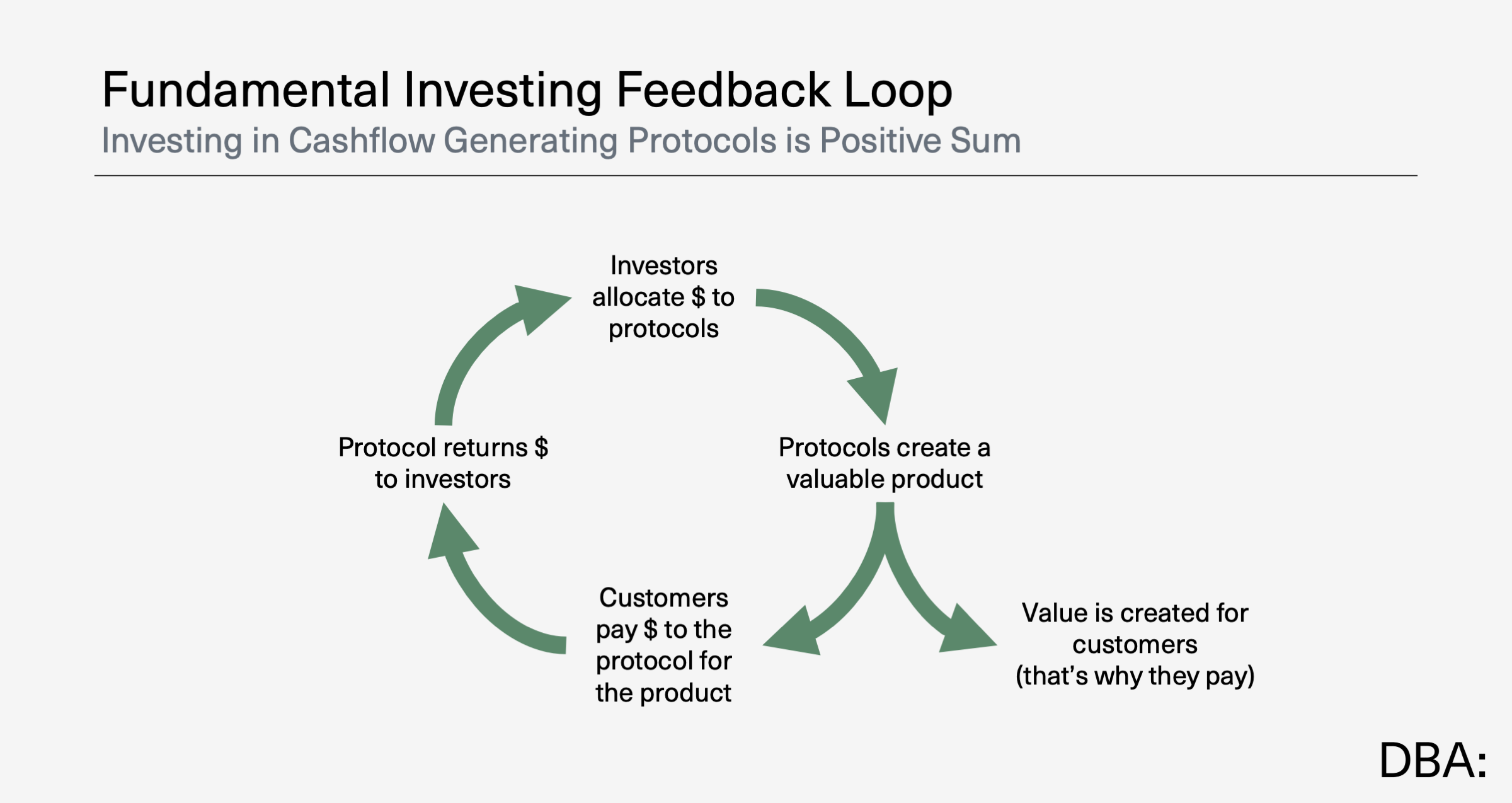

Crypto needs this feedback loop that fundamental investing creates:

Thankfully for crypto, the general trend we’ve been seeing is:

- Crypto investing is becoming relatively more fundamentals-driven – We’re finally getting more tokens generating serious cashflow, token transparency frameworks are gaining adoption, and token valuation frameworks are becoming more well-understood. We’re seeing much wider dispersion in token returns as a result.

- TradFi investing is becoming relatively more flows-driven – The world continues to get weirder and more degenerate. Meme stocks and crazy IPO pops are becoming more common. It pays to understand what will be the next hot narrative.

Someday they’ll converge, and we’ll just be talking about investing. One thing will remain the same though – fundamentals and flows will both still matter.

Disclaimer: The views and opinions expressed herein are the personal views of the respective author(s), do not necessarily represent the views of DBA Asset Management, LLC (“DBA”) or its personnel or affiliates, and are subject to change at any time without notice or any update hereto. This post is made available for informational purposes only as of the date of publication or as otherwise provided and should not be interpreted as investment, financial, legal or other advice or an endorsement, offer or solicitation of any kind. Investing involves risk. You are strongly encouraged to consult your own advisors. Some information contained herein may be sourced from third parties, including portfolio companies of investment funds managed by DBA. While the author(s) believe(s) these sources are reliable as of the date of publication or as otherwise provided, they do not independently verify such information and make no representations regarding its present or future accuracy, completeness or appropriateness. For further disclosures see: https://dba.xyz/disclosures/.