Thank you to Hasu and Joe Coll for valuable feedback and review.

The views expressed in this post are solely my own, and do not necessarily reflect those of the reviewers.

Introduction

The top Bitcoin L2 will unlock one of the largest markets in crypto.

The potential is obvious. BTC is already worth ~$2tn on its way to surpass gold as the largest asset in the world. The dominant platform facilitating BTC usage will necessarily be gigantic.

However, most people today over-index on Ethereum L2s in trying to understand Bitcoin L2s. Unfortunately, reasoning by analogy leads to the wrong conclusions, including:

- Underestimating the market size – Bitcoin’s lack of programmability on L1 means that BTC L2s have a fundamentally larger market opportunity vs. ETH L2s.

- Missing what will determine the “winner” – Security will matter more and earlier on for BTC L2s compared to ETH L2s.

- Underestimating what’s possible to build – Recent breakthroughs have unlocked the ability to build Bitcoin ZK-rollups with optimistic-ZK bridges (carrying a 1 of n trust assumption), and they’re coming sooner than you think. Potential future Bitcoin upgrades could make them fully trustless (i.e., enabling direct ZK verification and removing the 1 of n).

Note that we will use the broader L2 definition throughout, ranging from trusted (e.g., sidechains) to trust-minimized (e.g., ZK rollups). We mostly focus on fully programmable L2s, rather than more specialized protocols (e.g., payment channels).

This post explains DBA’s Bitcoin L2 thesis, why we believe Strata will fulfill it, and why we’re so excited to back Alpen Labs on their mission to make Bitcoin even better.

BTC L2 TAM > ETH L2 TAM

We’ll start with mistake #1 – underestimating the TAM. BTC L2s present a far larger market opportunity than ETH L2s. This is partially obvious due to BTC’s larger market cap (~4.7x), but there’s another more important and fundamental reason:

- ETH L2s are for scaling. Ethereum L1 has fully programmable execution. L1 is home to far more valuable state than its L2s, even despite its limitations (slow and low throughput). L1 is also now starting to scale execution. ETH L2s enable the same use cases as L1, just faster and cheaper. L1 is still for real money, and L2 is for play.

- BTC L2s are for scaling and programmability. Bitcoin L1 lacks this functionality. Programmability is needed to unlock robust privacy, better self-custodial UX, and basic BTC DeFi. If the L1 can’t provide this, then the crown is up for grabs to build BTC’s dominant execution layer.

Most market participants use ETH L2s as their mental model for BTC L2s, but the correct comparison is to Ethereum L1. The winning BTC L2 will be Bitcoin’s execution layer. The execution layer for the best cryptoasset.

Just ask yourself – if Bitcoin had a fully programmable L1, would you use it? I certainly would. Thankfully, Bitcoin L1 doesn’t have this general-purpose execution, because this simplicity ultimately has its strengths for BTC’s moneyness. However, this functionality is incredibly valuable to layer on top, and L2s now have an opportunity to build exactly that.

This is particularly valuable to build considering execution layers demonstrate extreme power law distributions:

- Ethereum – Ethereum L1 facilitates the majority of valuable ETH execution. It continues to dominate metrics such as REV, DeFi TVL, and stablecoin issuance. Its L2s are all far smaller.

- Bitcoin – We can similarly expect a long-tail of smaller BTC L2s, with the largest BTC execution layer pulling ahead over time. However, because the L1 lacks programmability, the dominant BTC execution layer must be an L2. The only question is which L2 it will be.

So, what will determine the winner? Much like Ethereum L1 does for ETH, I believe that Bitcoin’s leading execution layer:

- Must meaningfully enhance BTC’s functionality (e.g., unlocking better privacy, self-custody UX, and basic DeFi)

- Must not meaningfully sacrifice on BTC’s strengths (e.g., secure self-custody, seizure resistance, and permissionless use)

This means security is paramount.

L2 Security

ETH L2s: Speed > Security

We’ll now address mistake #2 – concluding that high security won’t matter for BTC L2s because it hasn’t for ETH L2s.

Looking at the current ETH L2s:

- Secure – The three Stage 2 rollups currently live all have de minimis usage.

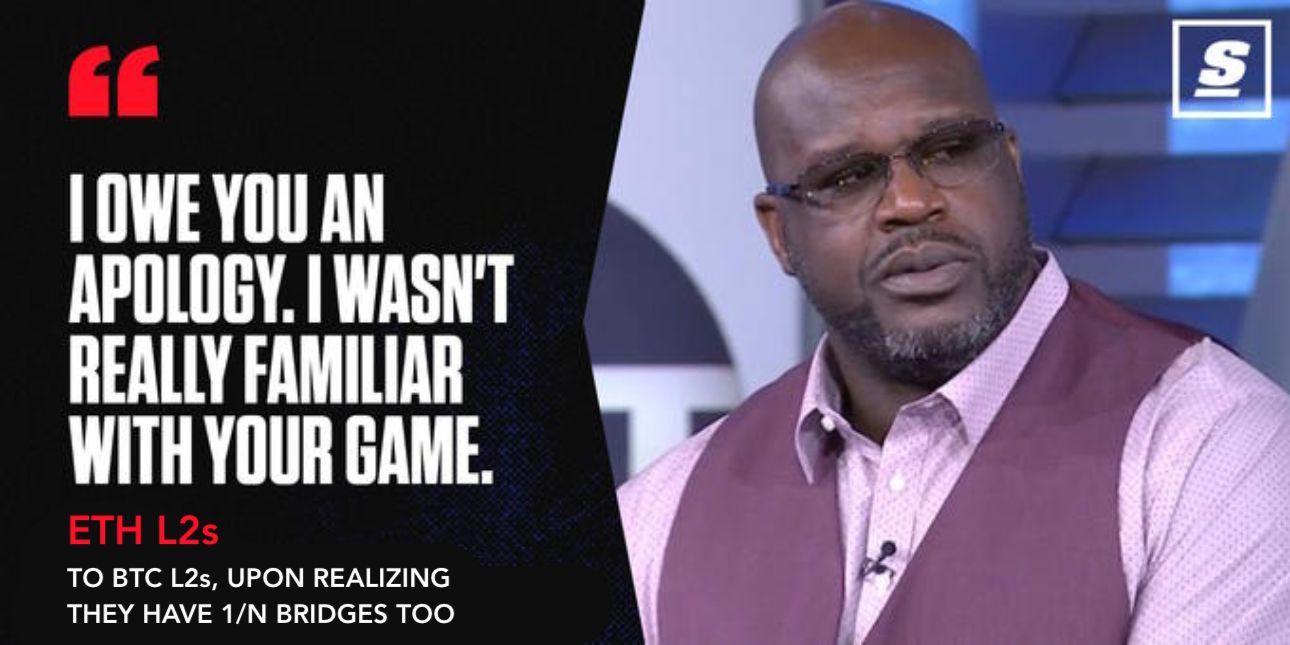

- Insecure – Users will, without hesitation, yeet billions of dollars into an “L2” deposit contract controlled by a 3/5 multisig of unknown signers, with no proof mechanism, and no chain. Even Base is still Stage 0. Optimism and Arbitrum have progressed to Stage 1, but with plenty of shortcuts along the way (e.g., Optimism had no proofs for years, and Arbitrum still has a whitelist).

Seeing this, many conclude that the winning BTC L2s similarly need to ship first, disregard security, and win users. Speed > security.

It’s a common view to even go a step further, concluding that rollups and validating bridges are a failed experiment. Users don’t seem to care about L2 security, and it’s not clear that L2s are incentivized to fully decentralize.

The common counterargument here is that security will matter more for BTC L2s because BTC holders are fundamentally more self-sovereign and risk averse than ETH holders.

I actually disagree with both sides:

- Drawing conclusions from the usage patterns of current ETH L2 users is misleading. Security will matter more and earlier on for BTC L2s compared to ETH L2s.

- However, that’s not because BTC and ETH holders have divergent risk profiles. I don’t believe there’s a meaningful difference here. Large capital holders are mostly rational in assessing risks, regardless of the asset.

So, I believe BTC and ETH holders have pretty comparable sensitivity to security risks. Also, as a result of over-indexing on those degen early ETH L2 users, many people underestimate just how sensitive most capital is to bridge security risks:

If capital is actually highly sensitive to bridge security, then why is all the ETH flocking to insecure bridges?

It’s actually quite simple – users just express this high security preference by not bridging at all! Only ~2.5% of the total ETH supply is bridged to L2s. ETH ETFs already hold more than that. Even hardcore Ethereans know that the current security of L2s (for simply holding ETH) is actually worse than that of the ETFs. Security is holding back the serious capital from L2s.

Absolutely love Base and have been using it a lot lately, but I don’t have much capital on it (or any rollup) because I’d only feel comfortable bridging in large sums once a rollup is at stage 2 decentralization.

Get to that and watch the money pour in big time imo.

— sassal.eth/acc 🦇🔊 (@sassal0x) January 1, 2025

The very real risk of getting zeroed out from a bridge hack produces a very high cost of capital. Low security = high risk = high cost of capital = less capital.

The reality is that most capital is pretty calculated and risk-averse here. You might gamble on L2s with your degen (i.e., risk-seeking) money, but you keep your serious (i.e., risk-averse) money on L1.

When we look at the usage patterns between L2 bridges today, we’re mostly just observing the preferences of this smaller degen capital pool. So:

- We cannot conclude that “L2 bridge security doesn’t matter” just because the major L2s have prioritized speed > security, and there’s far more ETH in these “less secure” L2s. Most capital just expresses their high security preferences by avoiding bridging altogether.

- We can conclude that amongst this small pool of degen capital, the incremental security difference between existing L2s is not the most important factor.

We also need to realize that prioritizing speed over security was the right strategic move for these early ETH L2s. They needed to ship fast and carve out a market segment. The incremental L2 security points didn’t matter to their target market of risk-seeking degens.

If you really wanted to play around with friend.tech when it launched, you’d keep a few bucks on Base. If you really want to ape a new AI memecoin on Base, you’ll throw some cash at it. Whether Base had fancy ZK proofs and time-locked contract upgradability would make little difference here.

Importantly, ETH L2s needed to target this smaller degen market because Ethereum L1 was always going to win the serious capital (at minimum for the early years). You can do your basic ETH DeFi on L1. You don’t need another copy-paste EVM with higher gas limits and the same apps to earn some yield on your ETH. Using L1 is strictly safer than bridging to an L2, and the higher L1 fees are marginal when transacting in size (i.e., when using serious capital).

This is not the case with Bitcoin:

- Bitcoin L1 is fundamentally incapable of natively hosting most basic functionality.

- This can change the value proposition and target customer of BTC L2s vs. ETH L2s.

- This can change the most important properties for BTC L2s vs. ETH L2s.

Absolute & Relative Security

Both the absolute and relative levels of security matter a lot here.

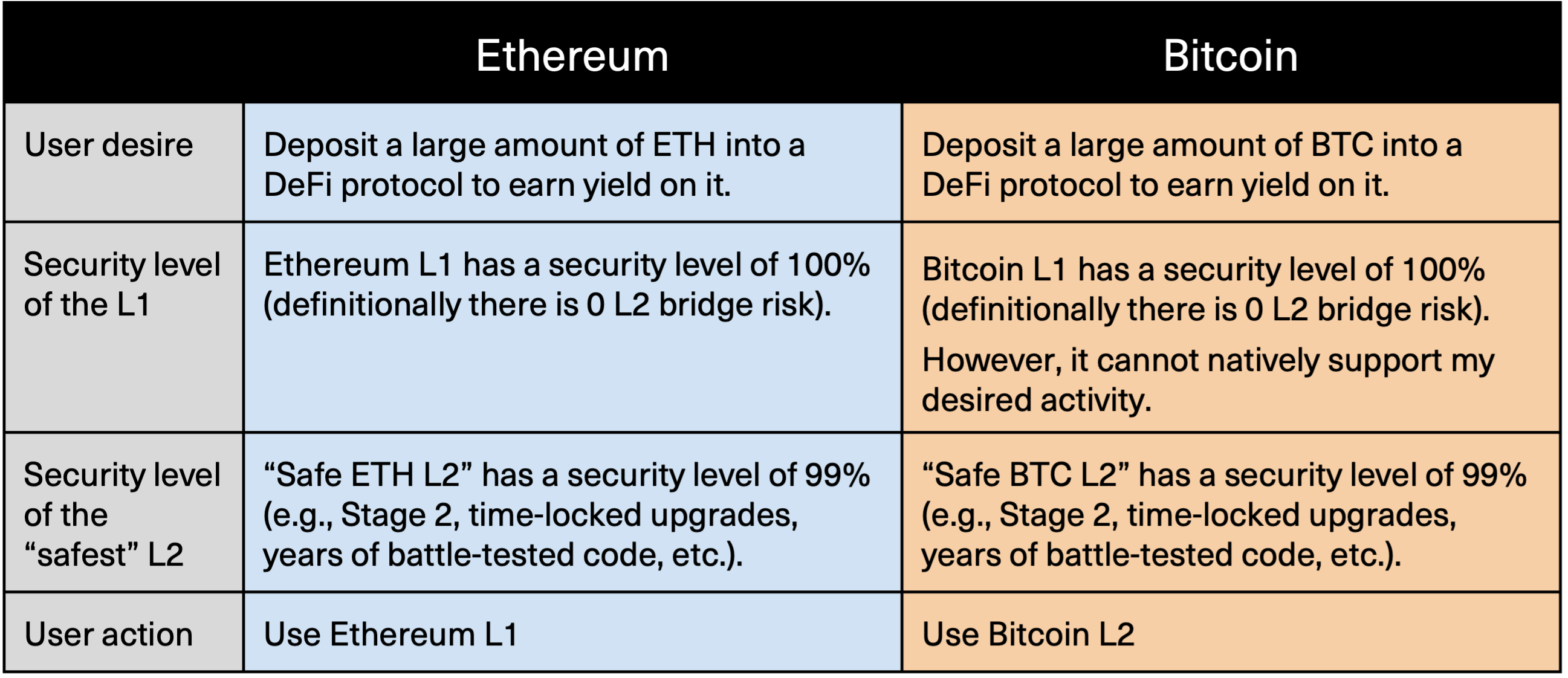

Consider two examples, where we assume for simplicity that we can precisely quantify the “security level” of an L2 bridge:

In the first example, you’d use Ethereum L1 despite the fact that Base’s security has advanced meaningfully. Basic DeFi protocols are generally deployed everywhere. The L1 gas fees also don’t matter much because this is a large transaction (incremental cost rounds to ~0). The same logic applies to most user behaviors (e.g., borrow/lend, swap tokens, use a mixer to privately transfer funds, restaking, etc.). I’ll use the L1 if I can.

In the second example, the user must use the Bitcoin L2, even though it’s just as secure as the Ethereum L2 which they opted not to use. I’ll note that there are some creative ways to use your BTC on L1 without fully programmable L2s (e.g., using DLCs), but they are generally quite limited, and most use cases are simply not possible.

L2s will optimize for different properties depending on their target customer:

- Ethereum – ETH L2s mostly haven’t optimized for the incremental security points because it wouldn’t have won them much business anyway with their target market of degens. Speed > security is the dominant strategy. Security only becomes the bottleneck once L2s start competing more directly with L1 to attract serious capital.

- Bitcoin – Security will matter more and sooner for the leading BTC L2s. Both degen (i.e., risk-seeking) and serious (i.e., risk-averse) capital have basic unsatisfied needs today. The go-to most secure BTC execution layer will be immensely valuable, and that spot is up for grabs.

Winning this market will require both:

- High absolute security – Imagine the safest BTC L2 was only at 50% security. For example, currently all programmable execution layers using BTC require honest majority assumptions (and often other even more concerning security practices). If my “minimum viable security” is not met, then I will either remain idly on the L1 and forgo my desired behavior (e.g., earning yield or improving privacy), or I will turn to centralized products (which is increasingly and concerningly the case).

- High relative security – Assuming there are L2s with minimum viable security to conduct my desired activity, then I will go to the most secure L2 available holding all else equal.

Unlike in Ethereum, building BTC’s go-to programmable execution layer already presents a huge market with relatively few competitors.

- Uncrowded Market – There just aren’t many people in the world capable of pushing the frontier here. Building on Bitcoin is hard work. Multiple groundbreaking research discoveries have been required over the past year alone to unlock the current state-of-the-art designs, and there’s a lot more hard work to be done with changes ahead. The vast majority of BTC L2s are going the easy route with security shortcuts.

- Huge Market – There’s the top dog, then there’s everyone else. Applications, capital, and builders will gravitate toward the leader. Bitcoin’s relatively constrained DA capacity also ensures that there won’t be many execution layers using its full security guarantees.

There will also still be that long tail of risk-seeking BTC capital where L2s can take security tradeoffs. However, this is a much smaller and already crowded market. In practice, the “winning” secure L2 will likely end up with lots of this activity anyway. Speculation tends to just follow whatever seems exciting and valuable. Most of the NFT craze on Bitcoin in the past year was certainly “speculative”, and Bitcoin certainly wasn’t optimized for them, but users paid up because it was fun.

Additionally, the “winning” L2 will likely branch out over time to onboard more users willing to accept some smaller security tradeoffs. For example, they may expand to volitions and L3s atop them to offer cheaper non-Bitcoin DA.

Alpen Labs

Altogether, Bitcoin’s leading L2 will need to be as close as possible to Bitcoin itself. Security is essential here, so building this L2 will require the team at the forefront of Bitcoin scaling R&D. Bitcoin culture will likely be important as well, so they’ll also need to be serious Bitcoiners who’ve been working for years to fulfill Bitcoin’s vision.

DBA believes that team is Alpen Labs. They’re building Strata, which we expect to be Bitcoin’s leading execution layer. Specifically, Strata is a zkEVM rollup (using SP1) on Bitcoin with a hybrid optimistic-ZK bridge.

Alpen Labs has been working to scale and extend Bitcoin using zk-SNARKs since 2022. They are by far one of the most impressive and principled teams we’ve ever seen. We genuinely could not be happier to back anyone.

They’ve already produced unmatched work in the space, leading up to their Strata design:

- Trey Del Bonis – In early 2022, Trey published a design for how a Bitcoin ZK-rollup would work.

- John Light – Later in 2022, John authored the landmark Validity Rollups on Bitcoin report which finally put Bitcoin rollups into the public spotlight. This ignited much of the work in this space.

- Simanta Gautam – In January 2023, several members of the Alpen Labs team (including Sims) wrote ZK Rollup on Bitcoin: Technical Whitepaper (summarized in this talk at BTC++).

- Liam Eagen – In April 2024, Liam co-authored the breakthrough On Proving Pairings (summarized in this talk at DBA’s annual Research Day) which was instrumental in enabling the Strata bridge. One of the best cryptographers around, Liam has also recently co-authored other incredible work such as Shielded CSV: Private and Efficient Client-Side Validation.

They’re even the go-to resource for more accessible explainers (which I certainly need), such as David Seroy’s whiteboard sessions on Bitcoin rollups and Strata’s BitVM2-based bridge. The team just keeps getting even stronger.

This caliber of team is required to build the most secure BTC bridge both today and in the future. These designs will evolve and harden further, especially with potential future Bitcoin soft forks enabling even better bridge designs (e.g., if OP_CAT is re-enabled).

Strata

Now let’s get into the design.

First, the ZK-rollup bit is actually the “easy” part. You could always easily launch a sovereign ZK-rollup on Bitcoin that has Bitcoin-level security for native assets. You just post the rollup data into Bitcoin blocks and create proofs of its validity. Rollup clients can then easily verify the rollup’s data availability and correctness.

However, we need Bitcoin nodes to also verify the rollup if we want to create a two-way bridge between them. That’s needed to bridge BTC into the rollup, which is of course the most interesting asset here. That’s the hard part – can we get Bitcoin to verify offchain execution, enabling a two-way peg for BTC?

The big breakthrough came with Robin Linus’ BitVM paper in October 2023 proposing a mechanism for optimistic verification on Bitcoin. While amazing, the initial implementation was admittedly clunky and inefficient with open security questions. It wasn’t clear if a practical implementation was possible.

In the past year, that has completely changed. It’s been getting less scuffed by the day, alleviating earlier concerns such as liquidity crunches (the subject of much debate earlier). The state-of-the-art Strata Bridge is a hybrid optimistic-ZK bridge heavily inspired by the BitVM2 paper. Alpen Labs’ collaboration with the other members of BitVM Alliance provided a foundation for their bridge. The Strata Bridge builds on the original BitVM design with many new optimizations using cutting-edge research to create a more practical, scalable, capital efficient, and secure bridge.

Put it all together, and you can build a Bitcoin ZK-rollup with an optimistic-ZK bridge that carries a 1 of n trust assumption for bridging BTC. This is Strata.

If you’d like to understand the tech wizardry under the hood in greater depth, I recommend David Seroy’s Strata Bridge whiteboard session and Alpen Labs’ blog post unveiling the design alongside their PoC implementation.

This isn’t the BitVM of a year ago, and it certainly isn’t today’s honest majority sidechains. A 1 of n security model is incredible. Hopefully, future Bitcoin upgrades (e.g., OP_CAT) will then enable direct ZK verification on L1 for a fully trustless design.

Strata Devnet has been live and open-source for several months. Public Testnet will be launching in the coming weeks, featuring the full Strata Bridge implementation. Mainnet this year.

The market is severely underestimating the recent developments in Bitcoin L2 technology.

Making Bitcoin Even Better

As both a Bitcoiner and an Alpen Labs investor, I don’t just want to see Strata “win” the existing BTC L2 market. I want the entire market to grow. That means making Bitcoin even better, and I strongly believe Strata will do that.

BTC is already the best cryptoasset. It’s got the story (e.g., it’s the first cryptoasset, anonymous founder) and the basic economics (fixed supply).

Like any cryptoasset, BTC also has better functionality than traditional assets – value can be transmitted permissionlessly and digitally to anyone in the world.

However, BTC has other functionality shortcomings vs. traditional assets (e.g., gold) and other cryptoassets (e.g., ETH and USDC). It lacks native robust privacy, scalability, speed, easy self-custody, interoperability with other assets, basic DeFi functionality, and more. This functionality matters a lot. That’s why onchain dollar stablecoins continue to eat offchain dollars. The strength of a given asset as “money” is a function of many different properties, and programmable money is stronger.

Unfortunately, trying to make BTC scalable and programmable today requires completely sacrificing some of its other best properties – self-custody, seizure resistance, and permissionless use. So, can we have our cake and eat it too?

Better L2s are needed to bring this functionality and scalability to BTC without sacrifices. They will unleash BTC in the same way that crypto rails are unleashing the dollar. They will make BTC even better money.

Specifically, BTC is primarily used as a SoV today (“digital gold”). It isn’t used much as a UoA or MoE (“electronic cash”). Adding the functionality described here would enhance all three functions of money for BTC. Making BTC more usable is obviously necessary if it has ambitions to become a MoE and UoA. However, I often hear arguments that if BTC limits its ambitions to a SoV (“digital gold”), then it doesn’t need this. I strongly disagree. Even digital gold needs privacy, better self-custody, and scalability. If BTC ownership and use becomes mostly custodial and centralized (without even a credible decentralized fallback), it’ll have a hard time even beating out the shiny gold stuff. Further, you should be able to put your SoV to work – BTC is pristine collateral (e.g., for use in DeFi) which is currently underutilized as such.

If we don’t securely add scalability and functionality to BTC, then users will be forced back into the hands of the intermediary financial institutions that we’ve fought so hard to cut out ever since the very first line of the Bitcoin white paper:

- If we don’t make BTC self-custody and private payments easier and more scalable, we’ll end up with dominant BTC custodians and payment providers.

- If we don’t enable basic BTC DeFi, we’ll end up with BTC CeFi.

- If we don’t build maximally secure and decentralized L2 bridges, we’ll end up with the likes of cbBTC creating centralized chokepoints even within a supposedly “DeFi” ecosystem.

This has been well known for a long time, as Hasu described years ago, “We must make sure that enough demand from the market can be met with trustless capacity, or risk that the custodial banking system will forever encumber the base layer.” Modern L2 technology such as Strata is essential in making sure this never happens.

Additionally, these L2s are the best path to provide a consistent security budget for Bitcoin miners long-term as the block reward goes away. It’s not clear that simple L1 BTC transfers will otherwise ever be sufficient. Expanding Bitcoin’s usage as a DA layer appears to be the most compelling way to provide steady income. It will diversify the types of BTC activity and enable a lot more of it (you can fit more L2 transactions than L1 transactions in the same amount of L1 data), increasing the economic density of L1 transactions. Bitcoin is unique in that it will actually be able to consistently charge a premium for DA, given there is demand to use BTC with minimal trust. I think this is very likely to be the case, given that money has the strongest network effects in crypto, and BTC is the king.

Bringing this functionality to Bitcoin without tradeoffs is essential, no matter whichever type of Bitcoiner you are:

- Bitcoin missionary – The primary objective is for Bitcoin to have a positive impact on society.

- Bitcoin mercenary – The primary objective is $BTC number go up, even if that comes along with a custodial surveillance state dystopia.

For the missionaries, it’s obvious that we need to enable private, scalable, and easier use of BTC for it to make a positive impact. For the mercenaries, this functionality makes BTC better money = increasing adoption and increasing price. Bitcoin’s security budget also needs to be addressed for it to continue having a positive impact and for the price of BTC to keep going up long-term.

Conclusion

Bitcoin L2s just make the most sense:

Unless you rely on custodians, honest majority of signers, or alt-L1s, all of these use cases are possible only thru a proper Bitcoin L2.

BTC-backed loans

BTC-backed stablecoins

Private, instant BTC payments

Flexible, scalable BTC vaults

etc…

— Simanta Gautam (@simanta_gautam) January 5, 2025

Everyone is starting to realize it:

the dark horse of the next 2 years could very well be BTC L2s extending the use of Bitcoin as an asset

actually a very useful case of employing L2s

— mert | helius.dev (@0xMert_) January 5, 2025

DBA believes that Strata will fulfill this vision. That’s why we couldn’t be more excited to support Alpen Labs in their journey to make Bitcoin even better.

Disclaimer: The views and opinions expressed herein are the personal views of the respective author(s), do not necessarily represent the views of DBA Asset Management, LLC (“DBA”) or its personnel or affiliates, and are subject to change at any time without notice or any update hereto. This post is made available for informational purposes only as of the date of publication or as otherwise provided and should not be interpreted as investment, financial, legal or other advice or an endorsement, offer or solicitation of any kind. Investing involves risk. You are strongly encouraged to consult your own advisors. Some information contained herein may be sourced from third parties, including portfolio companies of investment funds managed by DBA. While the author(s) believe(s) these sources are reliable as of the date of publication or as otherwise provided, they do not independently verify such information and make no representations regarding its present or future accuracy, completeness or appropriateness. For further disclosures see: https://dba.xyz/disclosures/.